empirica Housing Market Index

The empirica housing market index is an important tool for assessing the price development of supply data on the German property market. It provides a comprehensive overview of the price movements of residential property in various regions of Germany.

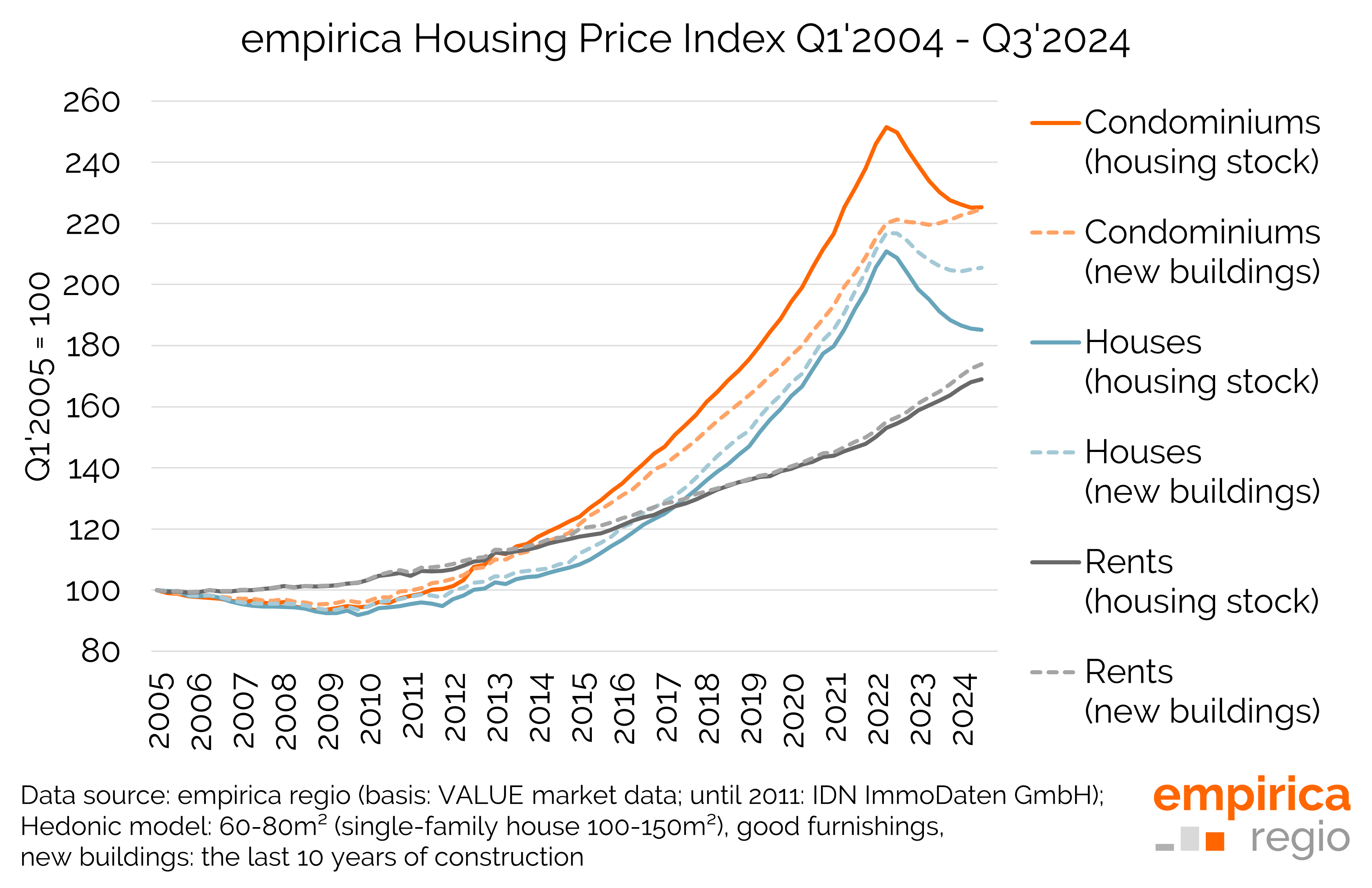

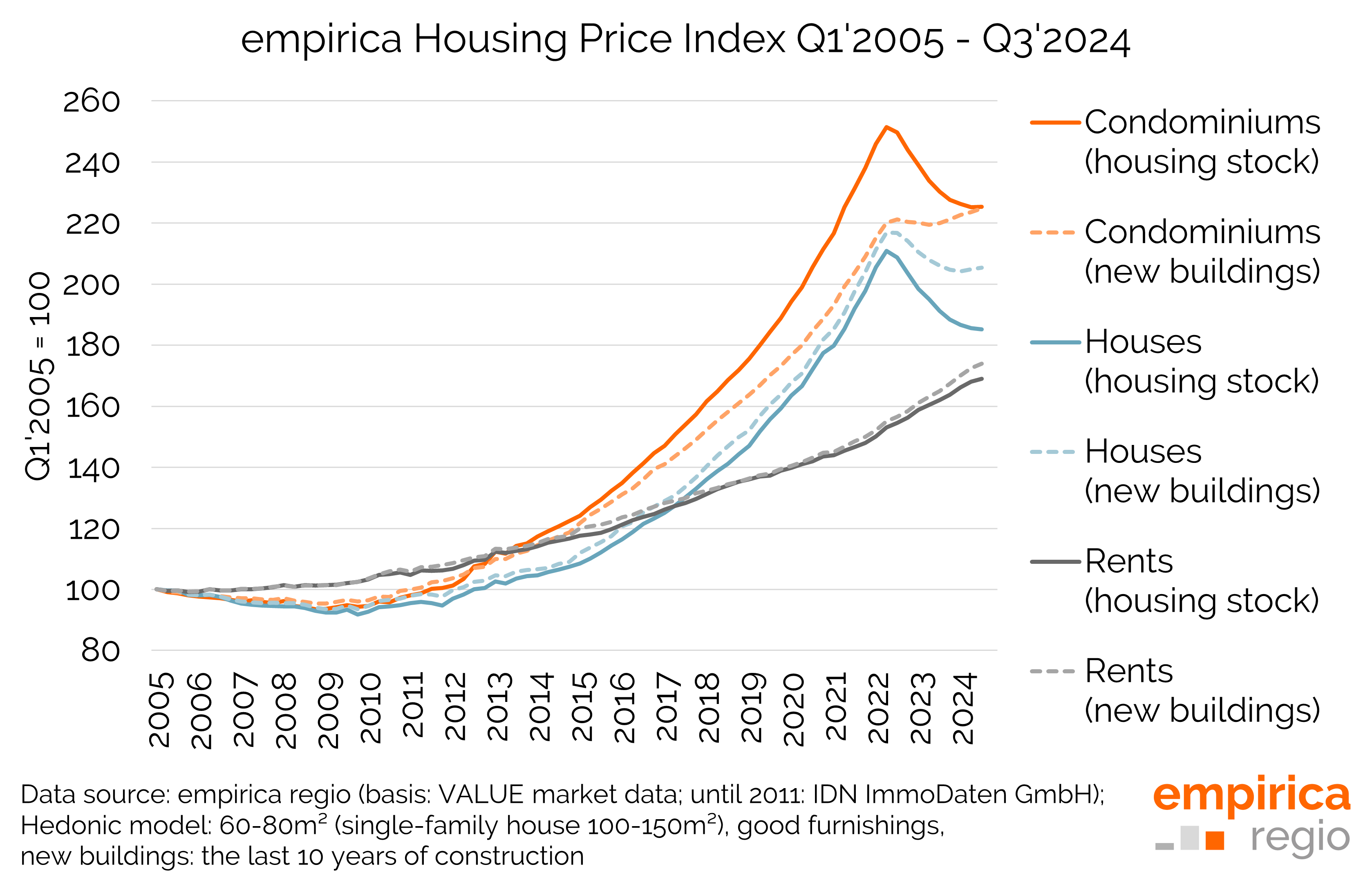

The empirica property price index up to and including Q1/2025 paints a differentiated picture of the property market. New-build prices, particularly for condominiums and detached/two-family houses, continue to rise. By contrast, prices for existing flats remained largely stable or fell slightly until the end of 2024, with signs of a slight recovery in Q1/2025. Rental prices are rising continuously, but show a slight cooling compared to the previous year.

Purchase Options

Are you interested in the empirica Housing Market Index? You can obtain the data at district level from empirica regio as access to the empirica regional database (Market Studio and RESTful API ). In addition to access to the housing market index, you benefit from a wide range of other data. You also get immediate access to the updated index as soon as it is published.

If you are interested in a consultation appointment or an individual offer to obtain the empirica housing market index, please contact us by e-mail at info@empirica-regio.de or under +49 (0) 30 884 795 55.

Data Source and Methodology

The empirica price database for property prices dates back to 2004 and is by far the largest collection of property listings in Germany. Since 2012, we have based our analyses on the VALUE market database, which offers a random sample independent of the reference date with professional Doppler adjustment (cross-sectional and longitudinal) and expert-supported plausibility checks. The hedonics used here are based on a bottom-up approach that aggregates from 400 regressions at district level to regional, federal state and national values.

Advertised asking prices are shown in euros/m², for 60-80m² (single-family homes 100-150m²), good fittings, new build (the last ten years of construction in each case) and all years of construction. The prices are adjusted using a hedonic procedure. This is necessary because the number of advertised flats can vary from quarter to quarter. The determination of hedonic prices is a procedure that takes into account changes in quality (furnishings, flat size, age of construction, etc.).

Detailed results and further information on the methodology can be downloaded from the empirica ag website: