Housing market data Q4/2024: New-build apartments at new all-time high

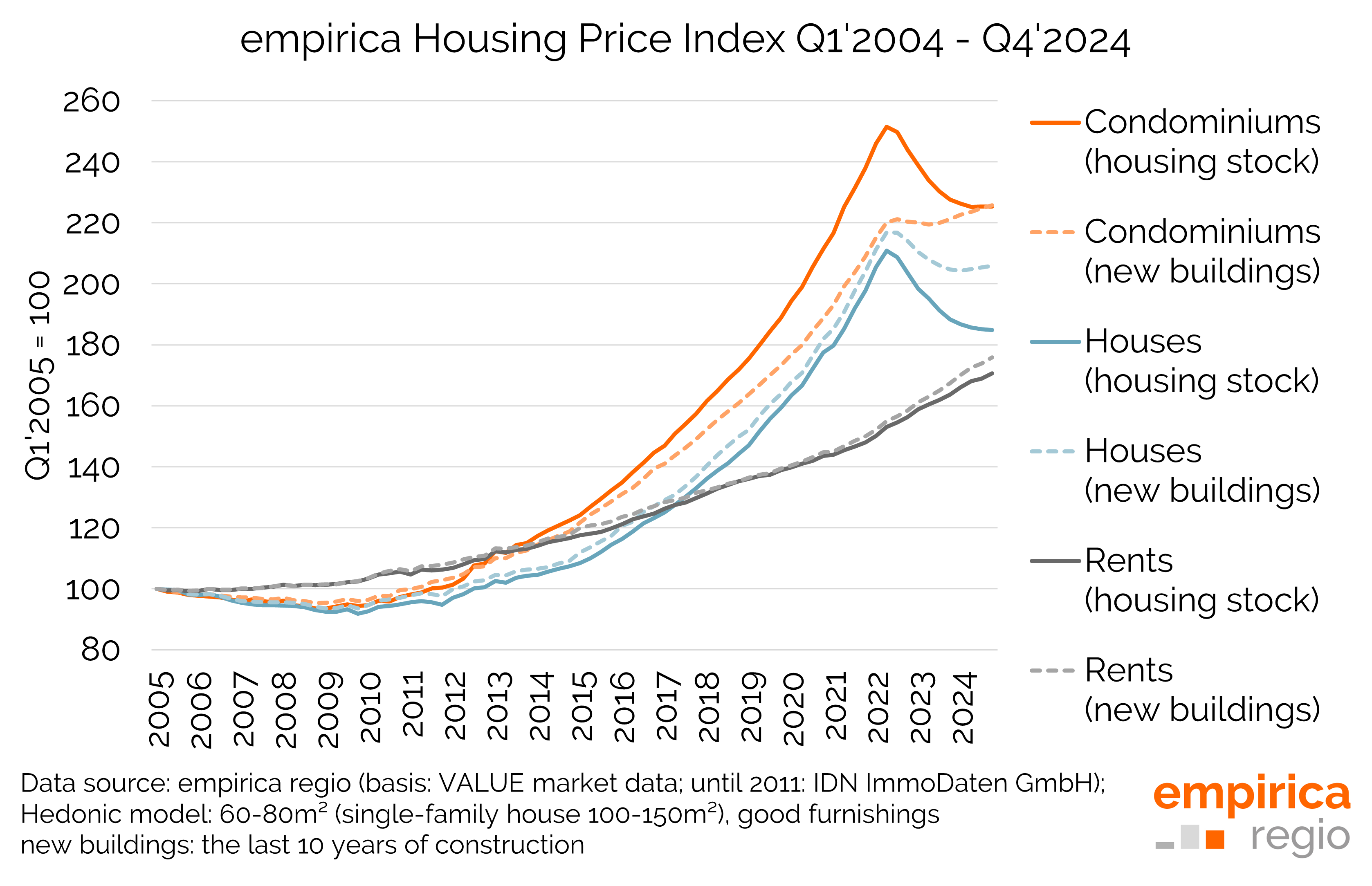

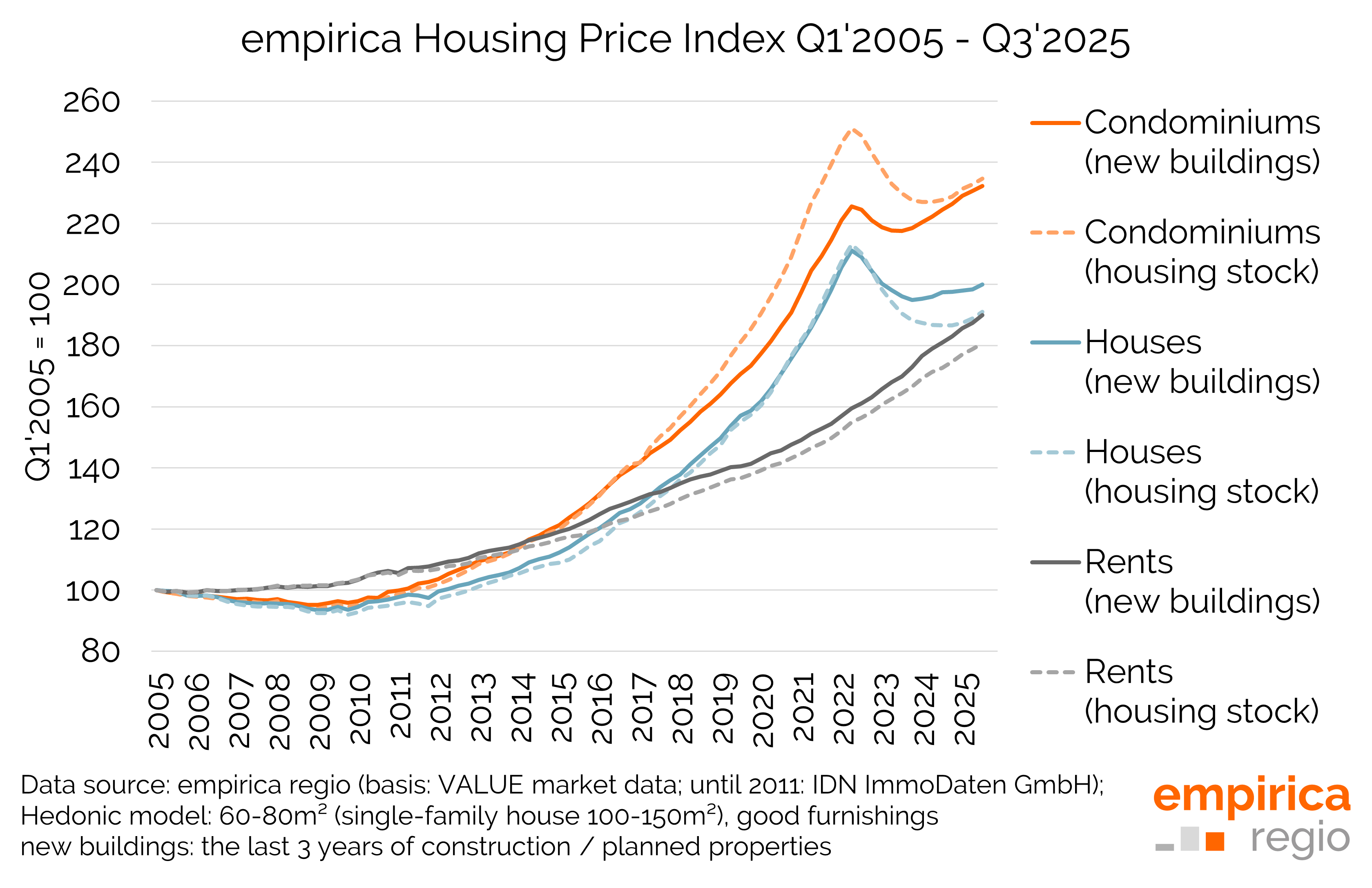

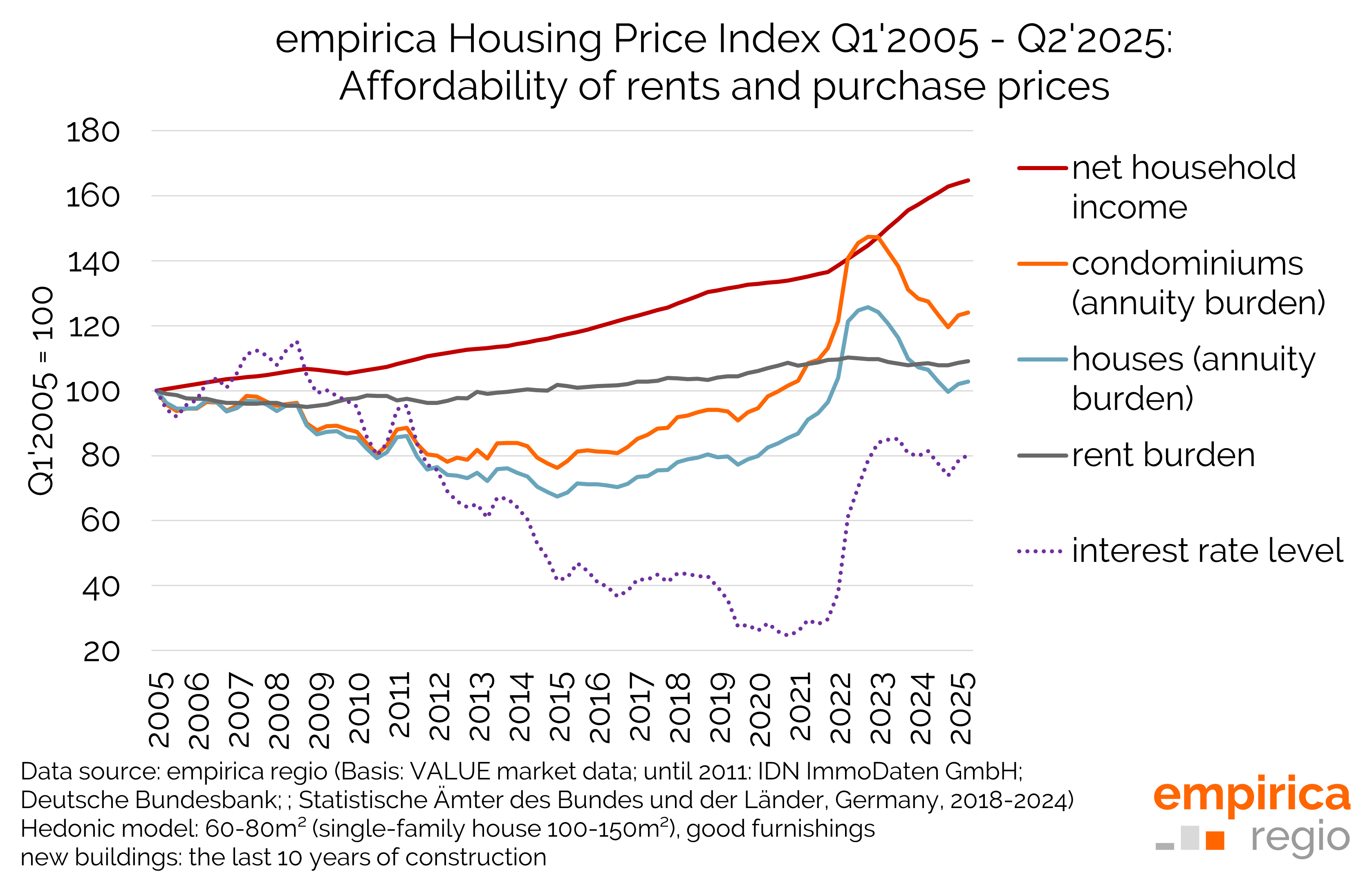

The latest data from the empirica property price index for Q4/2024 is now available. The advertised average prices for new-build apartments are thus once again setting new records, while advertised average prices for single-family homes are stagnating at a lower level. Advertised rents have remained unaffected by the crisis or have even risen consistently as a result.

Advertised purchase prices for newly built condominiums recently rose by 0.4% compared to the previous quarter (+2.1% year-on-year). The rate of increase for new detached/two-family houses was 0.2% (+0.6% year-on-year). Condominiums in the housing stock remained at the same level compared to the previous quarter (-1.0% year-on-year). Purchase prices for existing detached/two-family houses fell by 0.2% compared to the previous quarter (-3.8% year-on-year). The increase for new rental flats was 1.1% (+5.1% year-on-year) and for older rental flats 1.0% (+4.2% year-on-year).

Condominiums: Pre-crisis level exceeded in new construction

On a national average, the pre-crisis maximum advertised price for new apartments in Germany was €4,767/sqm in Q3/2022. The price fell to €4,728/m² (-1%) by Q2/2023 and reached a new all-time high of €4,863/m² in Q4/2024 (+2% compared to Q3/2022).

The situation is different for pre-owned apartments. Here, the pre-crisis maximum in Q2/2022 was €3,411/m², with the average price falling to €3,054/m² (-10%) by Q2/2024. Currently in Q4/2024, the price has barely recovered and is stagnating at EUR 3,057/m² (-10% compared to Q2/2022).

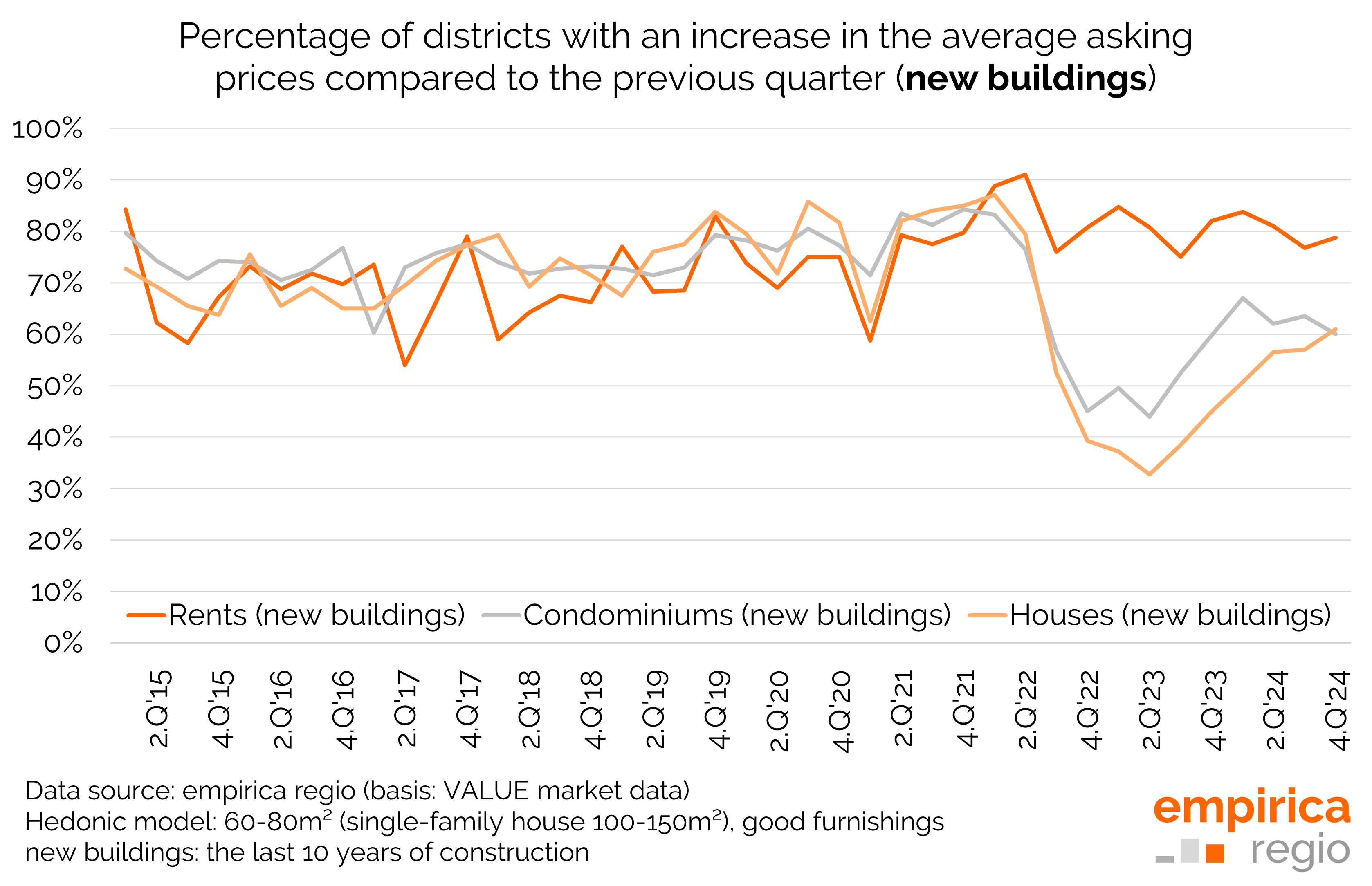

In the years 2015 to the first half of 2022, the quarterly values of new apartments rose in three quarters of all districts (75%). By the end of 2023, this was then only the case in half of all districts (52%), and in 2024 it was again the case in almost two thirds of all districts (63%) - trend: stagnating.

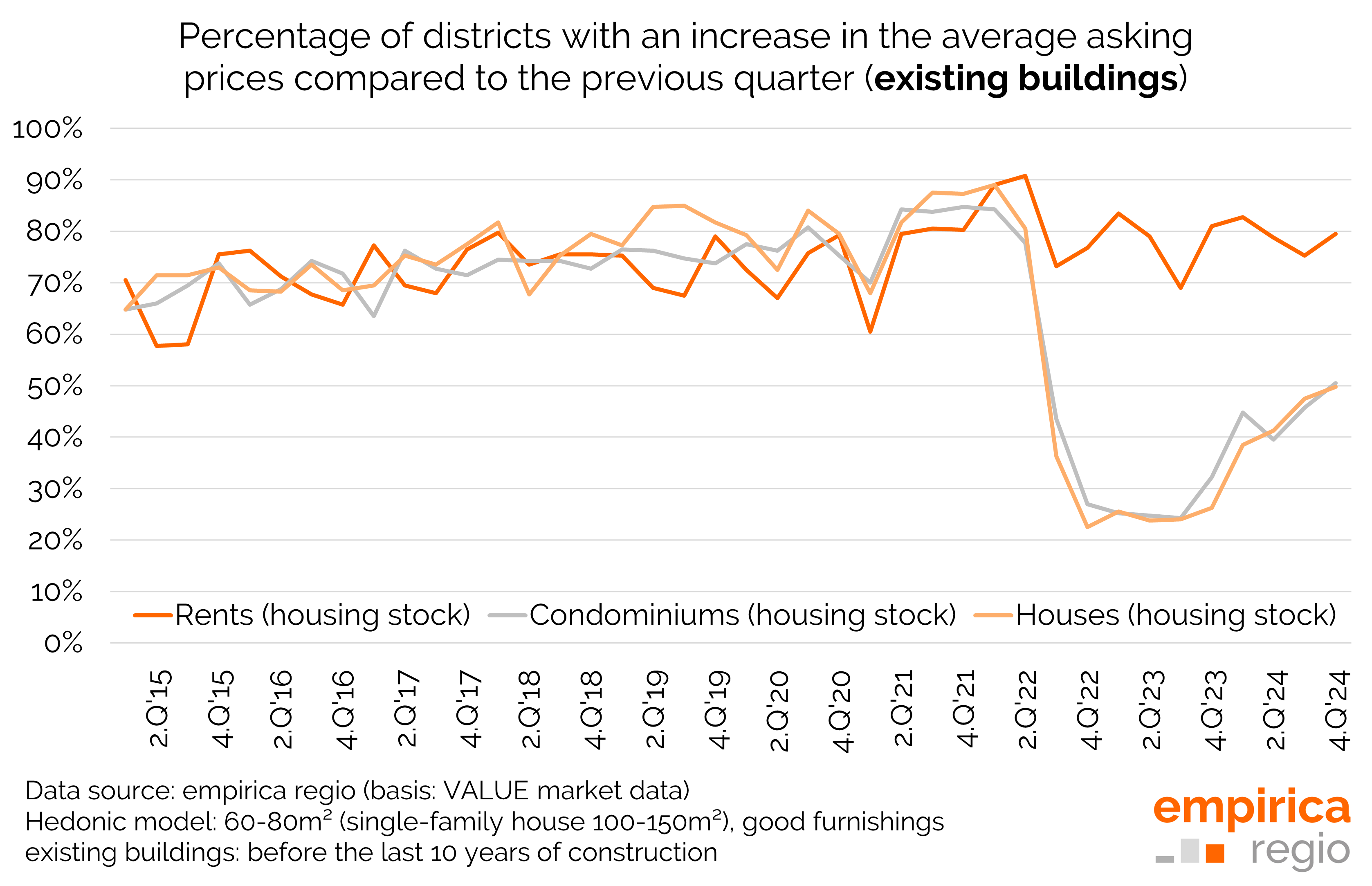

For a long time, the quarterly figures for the portfolio of single-family homes also rose in around three quarters of all districts (75%). By the end of 2023, however, this figure had fallen to just one in three districts (30%), and by 2024 it had risen again to almost one in two (45%) - with a rising trend.

Detached/two-family houses: pre-crisis level remains unrivalled

On average, the pre-crisis maximum advertised price for new single-family homes in Germany was €4,364/sqm in Q2/2022. The price fell to €4,110/m² (-6%) by Q1/2024 and had not yet recovered properly to €4,143/m² by Q4/2024 (-5% compared to Q2/2022).

The situation is even worse for second-hand single-family homes. Here, the pre-crisis maximum in Q2/2022 was €3,796/m², while the average price fell to €3,329/m² in Q4/2024 (-12%).

The quarterly values for new single-family homes also rose in three quarters of all districts between 2015 and the first half of 2022 (75%). By the end of 2023, this was then only the case in less than half of all districts (41%), and in 2024 it was again the case in just over half of all districts (56%) - and the trend is rising.

In the single-family home stock, the quarterly figures also rose for a long time in around three quarters of all districts (77%). By the end of 2023, however, this figure had fallen to just over one in four districts (27%), and by 2024 it was back to almost one in two (44%) - and rising.

Rents: Pre-crisis level far exceeded

The national average pre-crisis maximum advertised rent for new builds in Q2/2022 was €10.99/m². This rose continuously to €12.47/m² (+13%) by Q4/2024.

The situation is only slightly better for rents for second-hand flats. Here, the pre-crisis maximum in Q2/2022 was €8.82/m², while the average price fell continuously to €9.83/m² in Q4/2024 (+11%).

The quarterly figures for advertised rents in new builds rose in three quarters of all districts between 2015 and the first half of 2022 (73%). By the end of 2024, even in eight out of ten districts (81%) - trend: stagnating.

The quarterly figures for advertised rents for used flats also rose for a long time in around three quarters of all districts (75%). By the end of 2024, even in almost eight out of ten districts (79%) - trend: stagnating.

Data basis empirica housing market index

All empirica housing market index data can be obtained as individual data sets or via database access from empirica regio. Further figures can be found in the quarterly publication on the index.