Housing bubble index Q3/2023: Fewer and fewer regions at risk

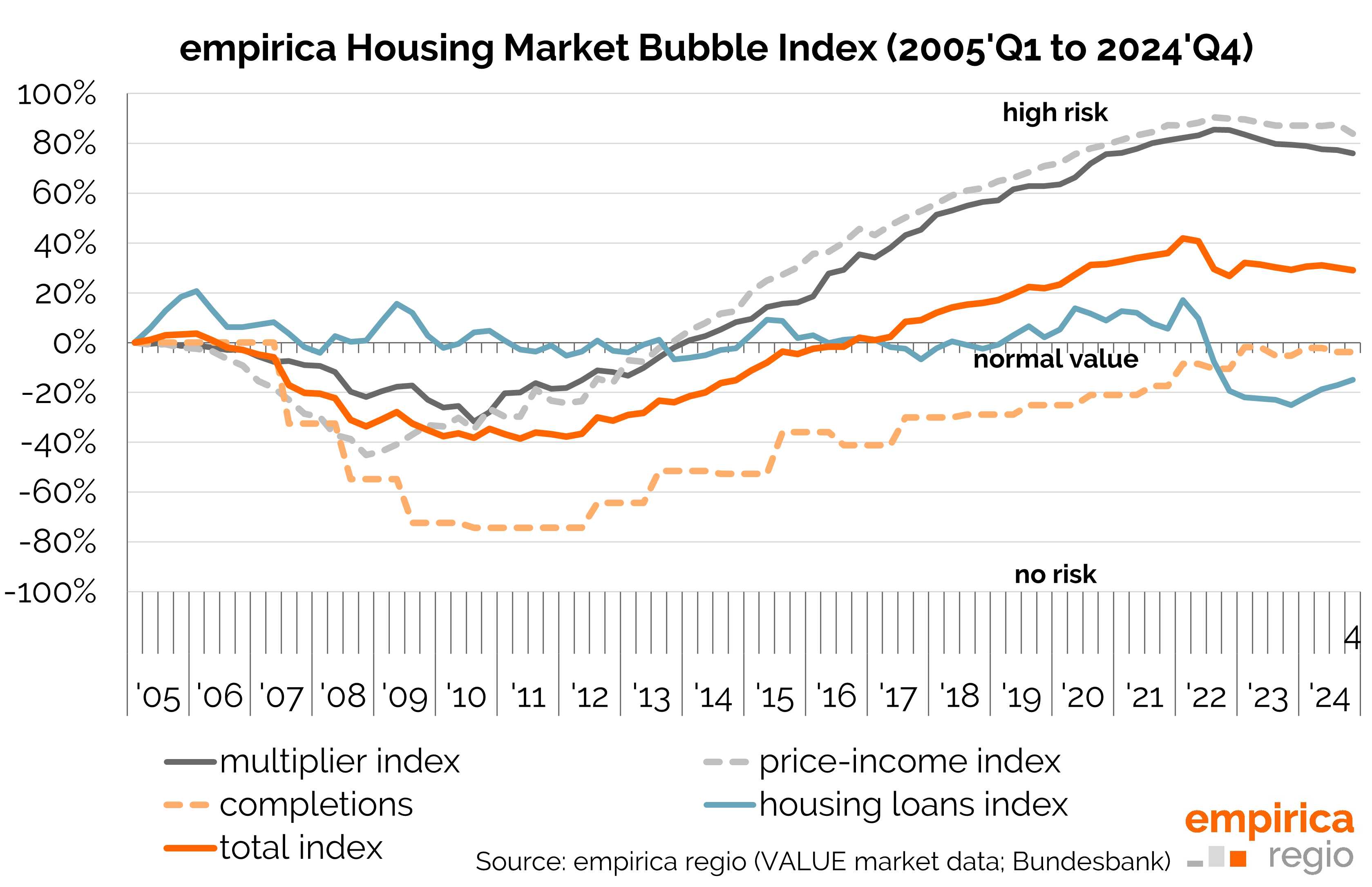

The empirica housing bubble index indicates that the risk of a housing market bubble in Germany is decreasing. In recent quarters, there has been a change: there are fewer and fewer vulnerable districts. The danger is still there, but its extent is getting smaller. The number of endangered regions has been falling for three quarters in a row.

All sub-indices, i.e., completions, multipliers, housing loans, and price-income, show a slight decline. The overall index is falling most sharply in swarm cities. Overall, the empirica bubble index now indicates a moderate to high bubble risk for 341 districts.

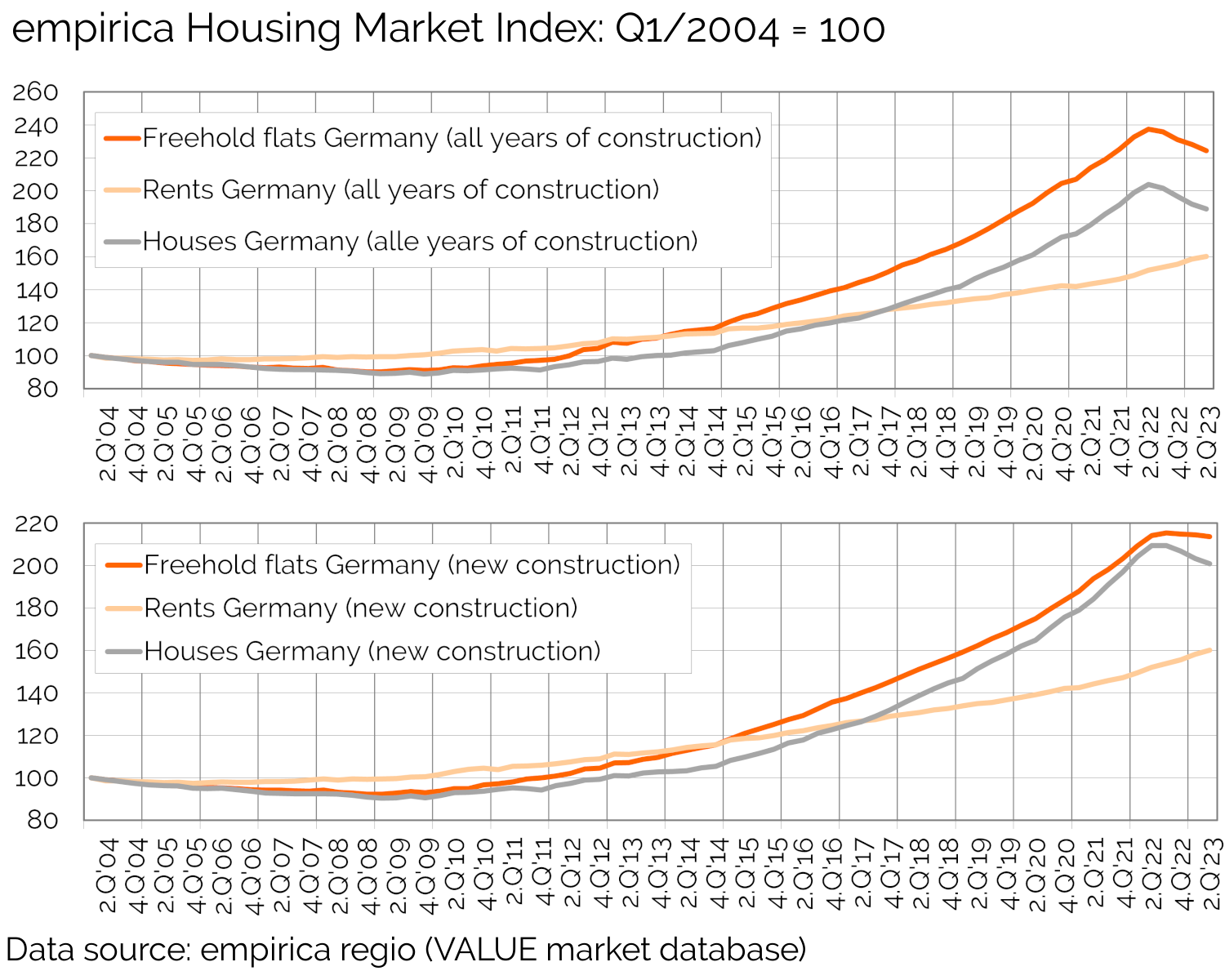

The rebound potential, which describes the relative price gap between purchase prices for condominiums and rents, has been falling nationwide since Q1 2022 and is now at 24%. The price increase in the top 7 cities now only has a lead of 34% over the rent increase. This trend is favored by high rent increases, which are caused by too little new construction with rising construction and financing costs.

The empirica bubble index is a quarterly published index that assesses the risk of a housing market bubble in various regions of Germany. The index shows the regional spread of a bubble danger. An detailed analysis of the current empirica Bubble Index (in German) has now been published by empirica for Q3 2023.