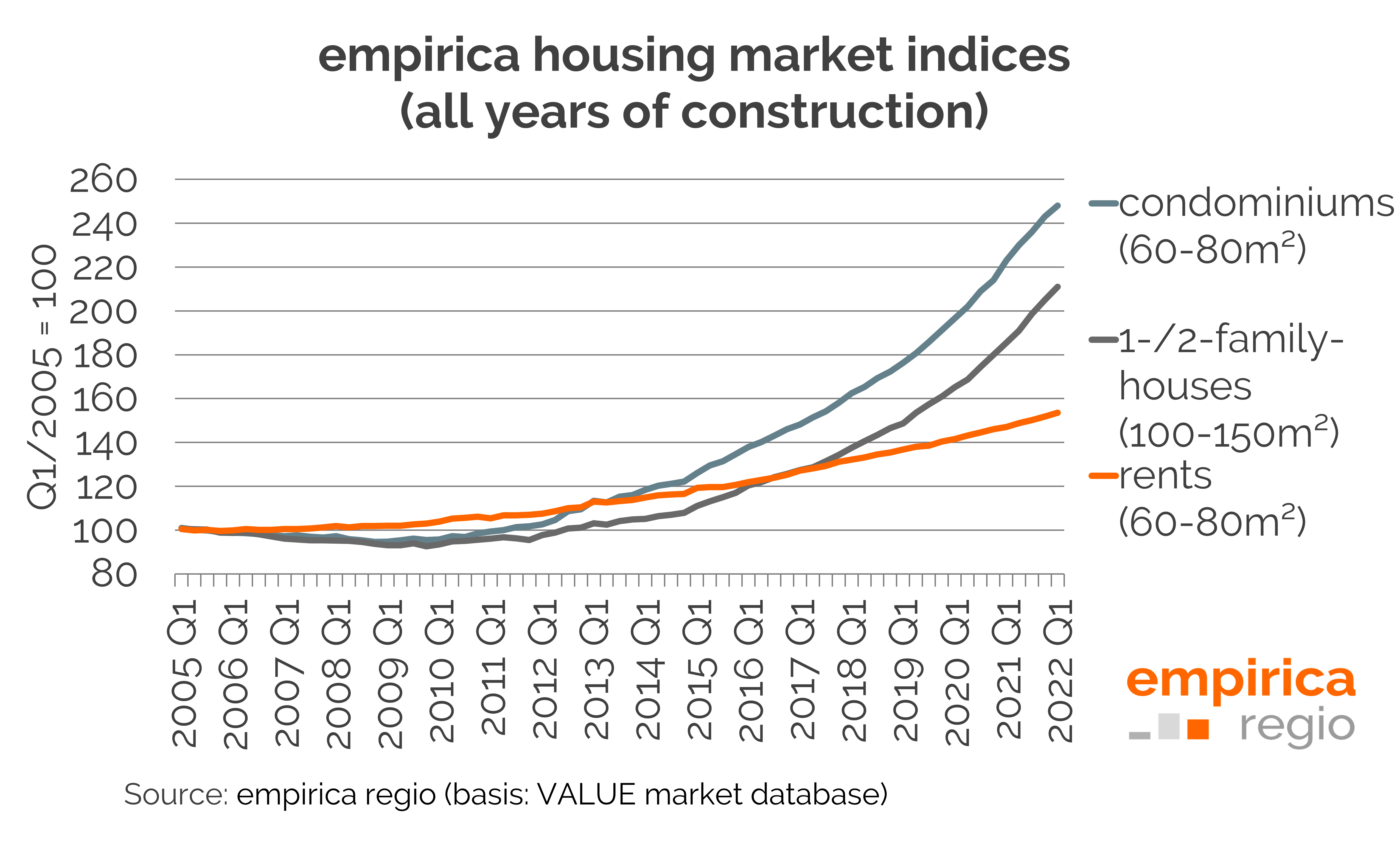

Housing market data Q2/2021: rents rise faster than purchase prices

With growth of 1.1 % compared to the previous quarter, purchase prices for condominiums rose less strongly than rents (+2.0 %) for the first time in a long time. Purchase prices for detached and semi-detached houses rose by 2.5 % compared to the last quarter.

The following charts clearly show the differences in Q2/2022 compared to the previous quarters. Since Q3/2017, the relative price development of rents to the respective previous quarter in the types of regions shown has never been above 2 %, while that of the purchase price has rarely been below 2 % and only in individual cases below 1 %. In Q2/2022, the picture is completely reversed.

With regard to the current interest rate development, the question arises as to the future price development: Are purchase prices falling now? For the last quarters, the current analysis by empirica shows that the share of districts with falling prices is increasing and the average price increase is decreasing. However, rising construction costs and supply bottlenecks, a shortage of skilled workers, the low level of new building land designation and issues such as mandatory redevelopment, subsidies and tightening of building laws are currently also influencing supply. The demand is not yet sufficiently satisfied and the housing supply threatens to become smaller. Rather, a differentiation of prices in different segments and regions is to be expected.