empirica housing market bubble index Q3/2021: Index continues to rise

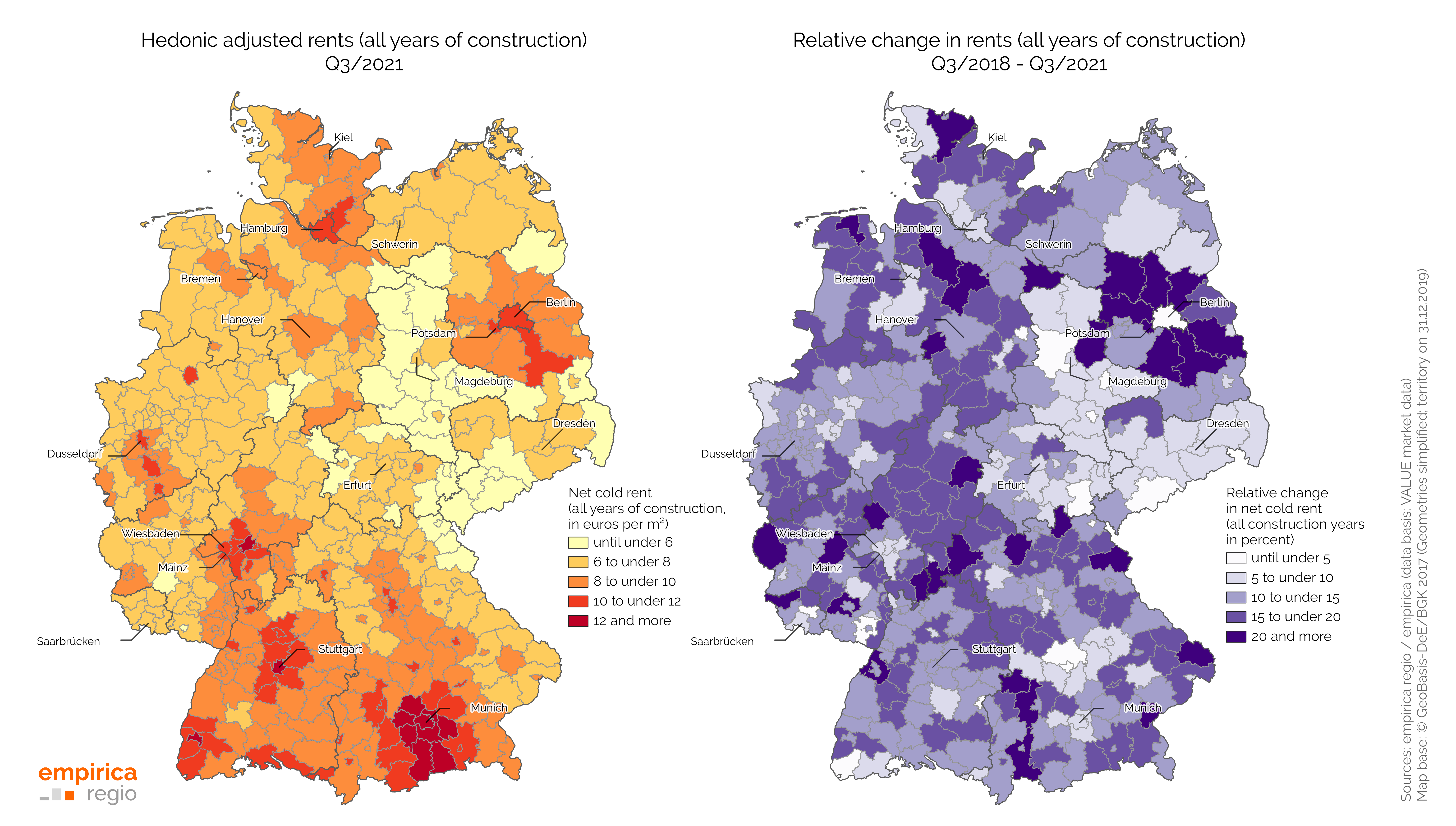

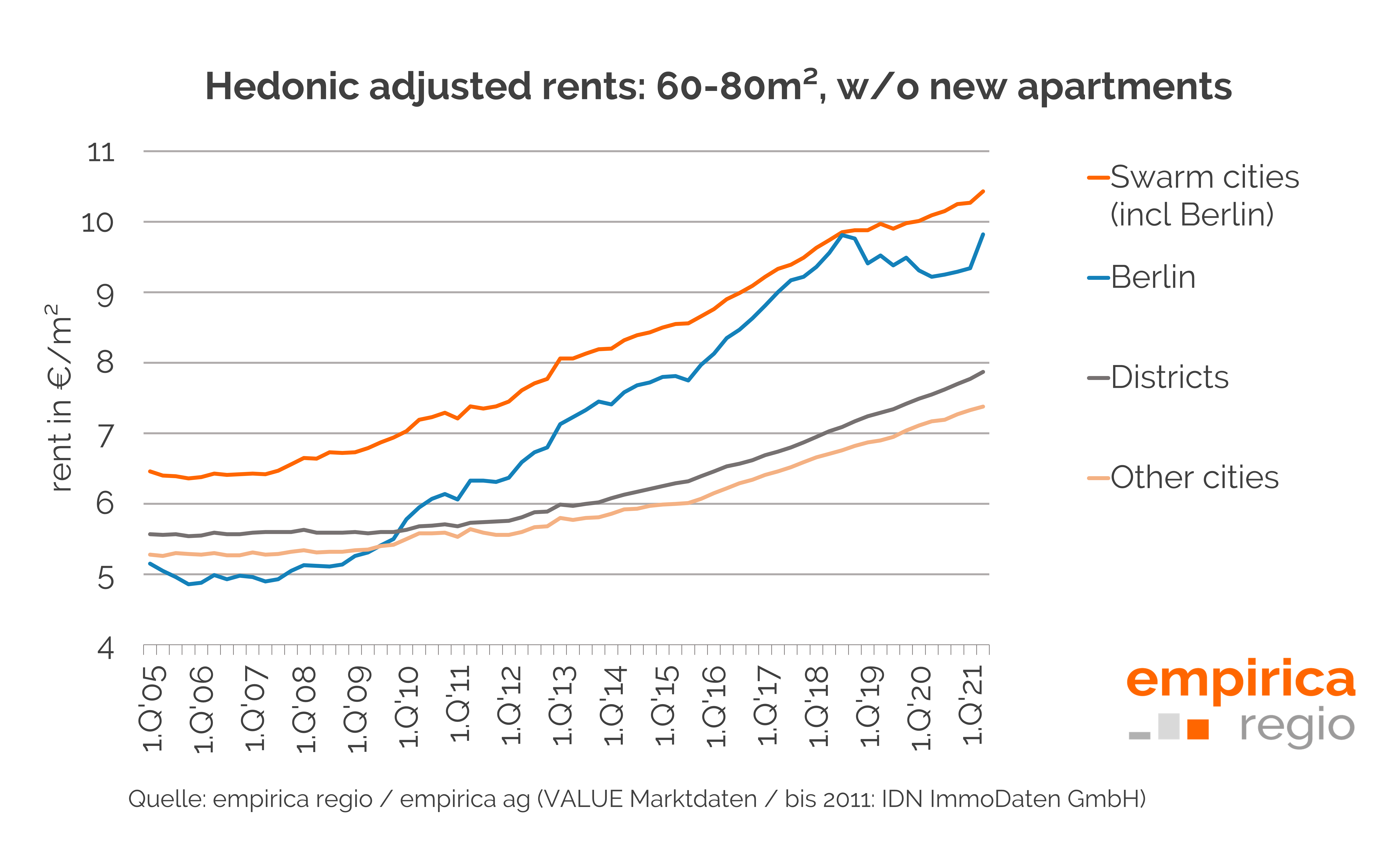

The empirica housing market bubble index rises more strongly in the third quarter of 2021, especially in the completions sub-index, and somewhat less in the multiplier and price-income sub-indices. The overall index rises most strongly in the swarm cities, followed by the growth and shrinking regions.

In 40 districts the index is currently in the “critical” range, including Hamburg, Schwerin and Regenbsurg for the first time. In 187 regions the index is in the “high” range. The number of districts in the highest category has decreased compared to the same quarter last year (-3), but has increased significantly in the second highest class (+36).

Data view of the empirica Bubble Index in the Market StudioIn the empirica bubble index, the three individual indicators - multiplier, price-income and construction activity - are monitored on a quarterly basis. The (regional) real estate bubble risk increases when the corresponding comparative values from 2005 or the empirica new construction forecast are significantly exceeded. The year 2005 represents a normal phase in which no one suspected a price bubble and the market was rather slightly undervalued. Further information on the current bubble index can be found on the website of empirica.