Exclusive analysis by empirica regio: contract rents rise moderately and thus more slowly than advertised rents

- Median contract rent will be EUR 7.21 per m² in 2023

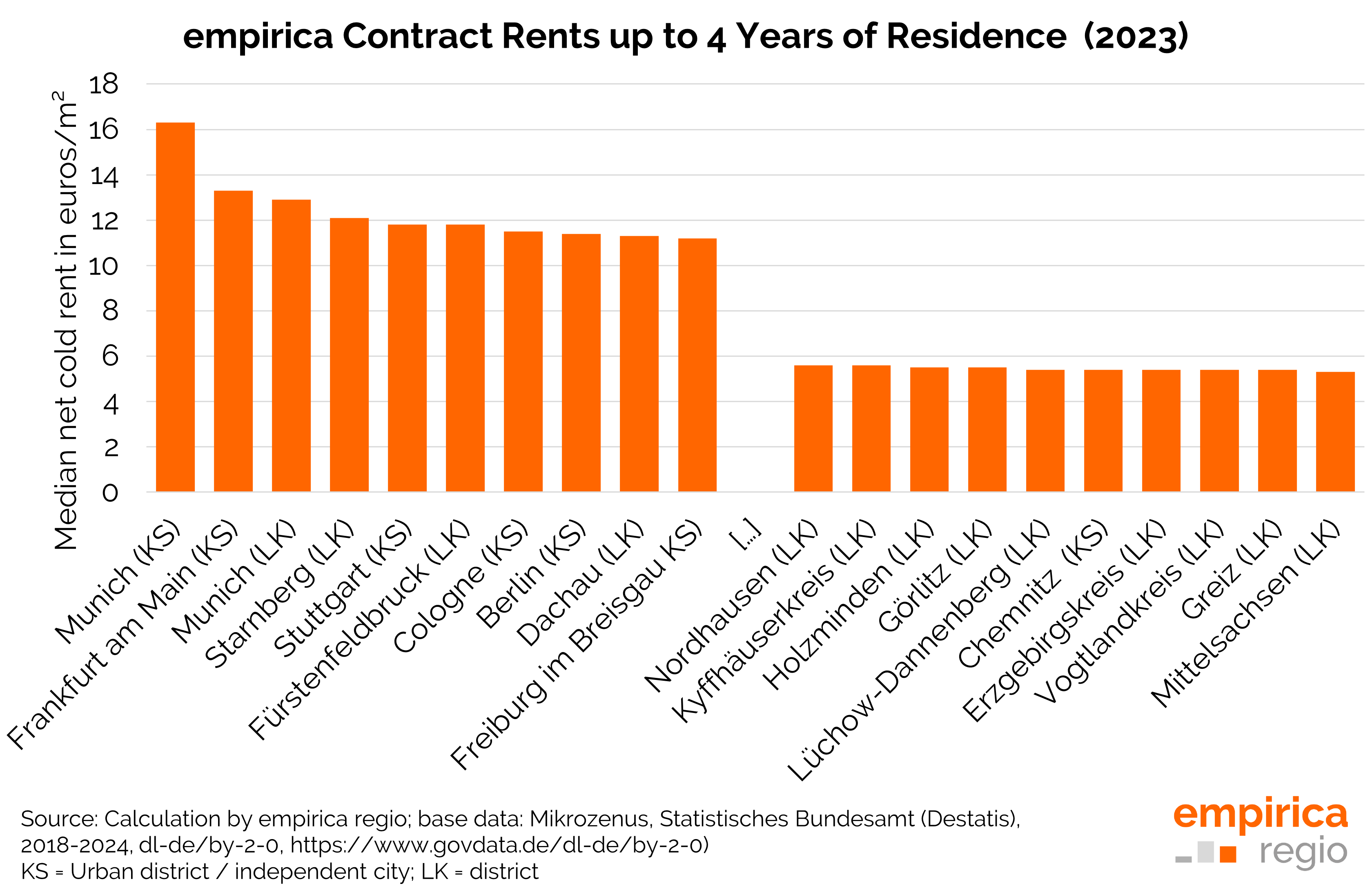

- Strongest increase in new contract rents in Dahme-Spreewald, lowest rents in Central Saxony

- City of Munich most expensive place to live in Germany at EUR 16.30 per m² - increase of 21 per cent in five years

The Berlin-based market data provider empirica regio has analysed the development of contract rents in Germany in a new study. The results show a moderate increase in the national average, major regional differences and some surprising declines. In 2023, the median contract rent in Germany was EUR 7.21 per square metre. Since 2018, this corresponds to an increase of a good 14 per cent, while the 10-year comparison shows an increase of 34 per cent - in 2013, the median rent was still EUR 5.54 per square metre.

Significant east-west divide remains noticeable

The analysis also makes it clear that there are still significant differences between eastern and western Germany. In the eastern German states excluding Berlin, the median rent in 2023 was EUR 6.04 per square metre, which corresponds to an increase of 29% in a 10-year comparison (2013: EUR 4.67). In contrast, the median rent in the western German states excluding Berlin was EUR 7.36 per square metre in 2023, also an increase of 29% compared to the EUR 5.69 in 2013.

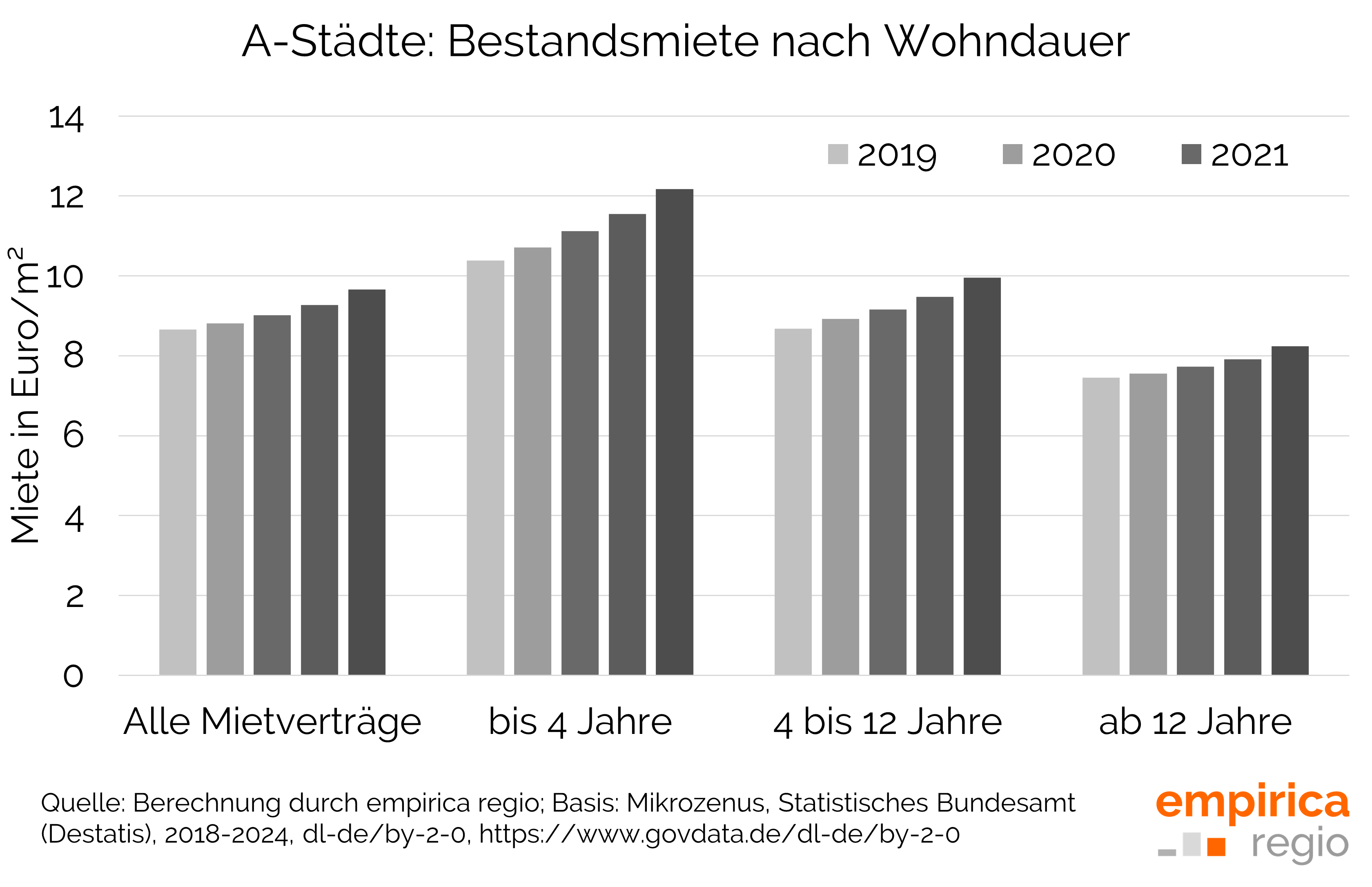

New contract rents rise more strongly - especially in the top 7

The available data on contract rents also makes it possible to differentiate the length of time households have lived in the property. In recent years in particular, there has been a disproportionate increase in new contracts with a maximum term of 4 years. Between 2018 and 2023, this was +19 per cent and therefore 5 percentage points higher than the average for all tenancy agreements. At EUR 8.30, the median level of new contracts in 2023 was around 15 per cent higher than the median of all rental contracts. In 2018, the relative difference was 11 per cent.

At +21 per cent, new contract rents in the top 7 have risen even more strongly than the nationwide trend since 2018, while the rent level across all tenancies has risen by +14 per cent. This means that the level of new contracts in 2023 was around 26 per cent higher than all rental contracts; in 2018, this difference was 19 per cent.

Dahme-Spreewald and Amberg with the highest rent increases

The regional difference is particularly clear in the regions with the strongest rent increases for tenancies of 4 years or less. The district of Dahme-Spreewald experienced the strongest increase in new contract rents in Germany between 2018 and 2023. Rents here rose by 45 per cent - from EUR 6.40 to EUR 9.40 per square metre. The city of Amberg followed with an increase of 44 per cent (EUR 5.70 to EUR 8.20), while the districts of Ostprignitz-Ruppin, Teltow-Fläming and Tirschenreuth each increased by 42 per cent. Grade explains this dynamic with increased demand in growing commuter belts: ‘The high growth rates in these regions reflect the dynamics of growing commuter belts. Demand here is increasingly outstripping supply and fluctuation on the housing market is high, which is driving up the prices of new contract rents.’

Low growth in individual cities

In contrast, some cities have seen only slow growth in new contract rents over the last five years. In Mülheim an der Ruhr, the median new contract rent rose from EUR 6.60 to EUR 6.90 (+5 per cent), in Chemnitz from EUR 5.10 to EUR 5.40 (+6 per cent). Gelsenkirchen, Ulm and Dresden also recorded only slight increases of 7 per cent each. In these cities, asking rents also rose at a below-average rate in the same period compared to other independent cities.

Taking inflation into account, there was even a real decline in rents in regions with less than 13 per cent growth in nominal median rents. ‘These developments make it clear that the rental market in some regions is developing less dynamically than is often assumed when only looking at asking rents. Tenants, owners and investors should therefore take a closer look,’ says Grade.

Cheapest regions in Central Saxony and Chemnitz

The lowest contract rents were observed in Central Saxony, where the median price per square metre was EUR 5.30 in 2023. This was followed by Chemnitz and the district of Greiz, both at EUR 5.40 per square metre. These regions also recorded only slight rent increases: Chemnitz recorded an increase of 6 per cent, Central Saxony of 8 per cent.

‘The favourable rents in these regions correlate with high vacancy rates. Anyone looking for a new, affordable flat will find it more quickly here. In very rural regions, however, the rental housing stock also represents a small segment in terms of the housing stock. It can still be difficult to find a rental flat here, even if rents are low,’ explains Grade. Munich remains the most expensive city

At EUR 16.30 per square metre, Munich remains the most expensive place to live in Germany. Since 2018, contract rents there have risen by 21 per cent (from EUR 13.50 per square metre). Frankfurt am Main is in second place at EUR 13.30 per square metre (+19 per cent), followed by the district of Munich (EUR 12.90 per square metre).

‘Munich remains the frontrunner - a clear sign of the city’s attractiveness, but also of the ongoing challenges of creating and maintaining affordable living space,’ comments Grade.

Solid development in Berlin, Hamburg and other metropolises

Berlin rose from 22nd place (2018) to 8th place (2023) in the ranking of the most expensive cities. Rents rose by 27 per cent - from EUR 9.00 to EUR 11.40 per square metre. Hamburg remains in 14th place at EUR 11.00 per square metre, while Stuttgart (EUR 11.80, +15 per cent) and Cologne (EUR 11.50, +17 per cent) showed stable increases.

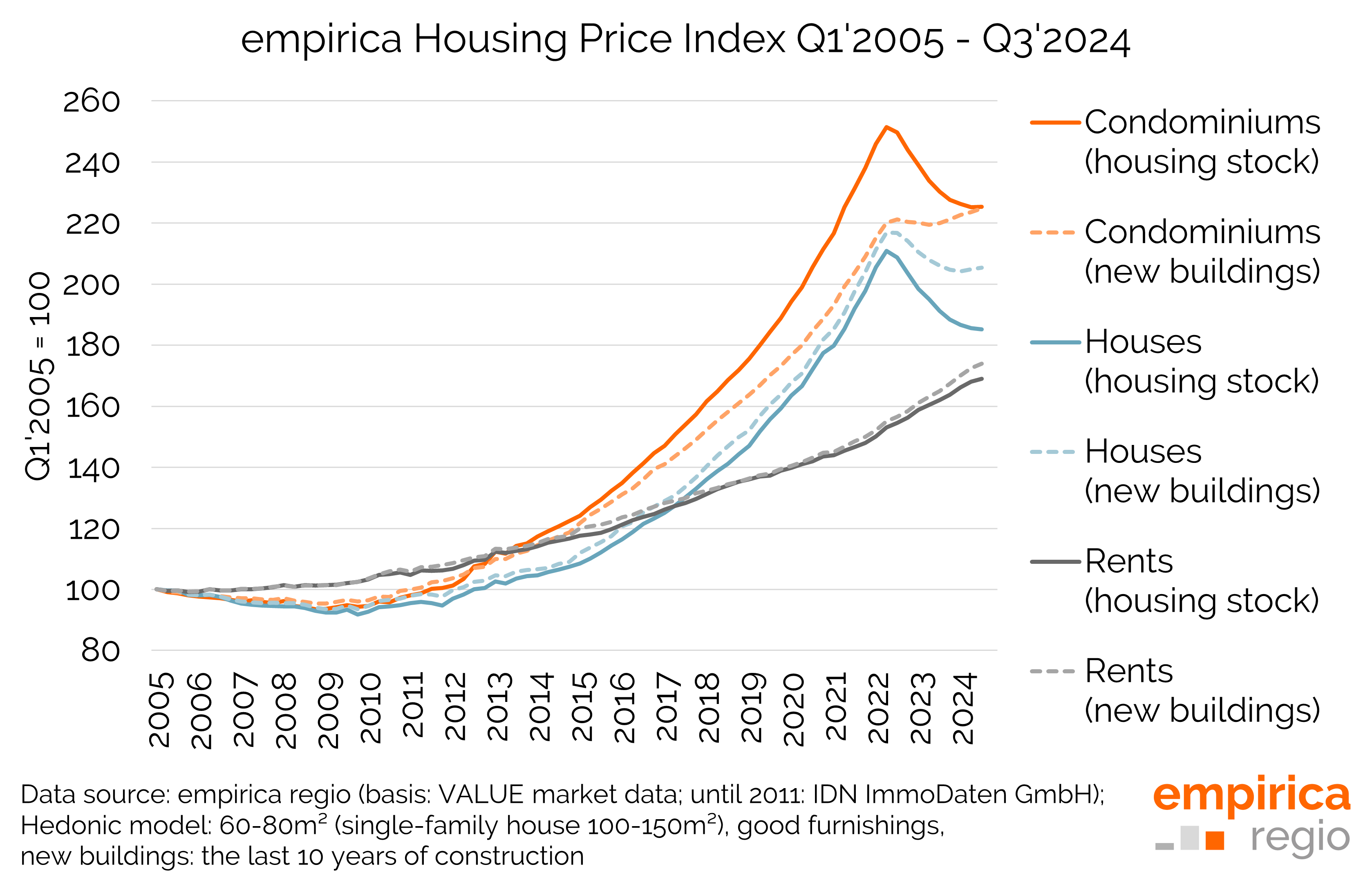

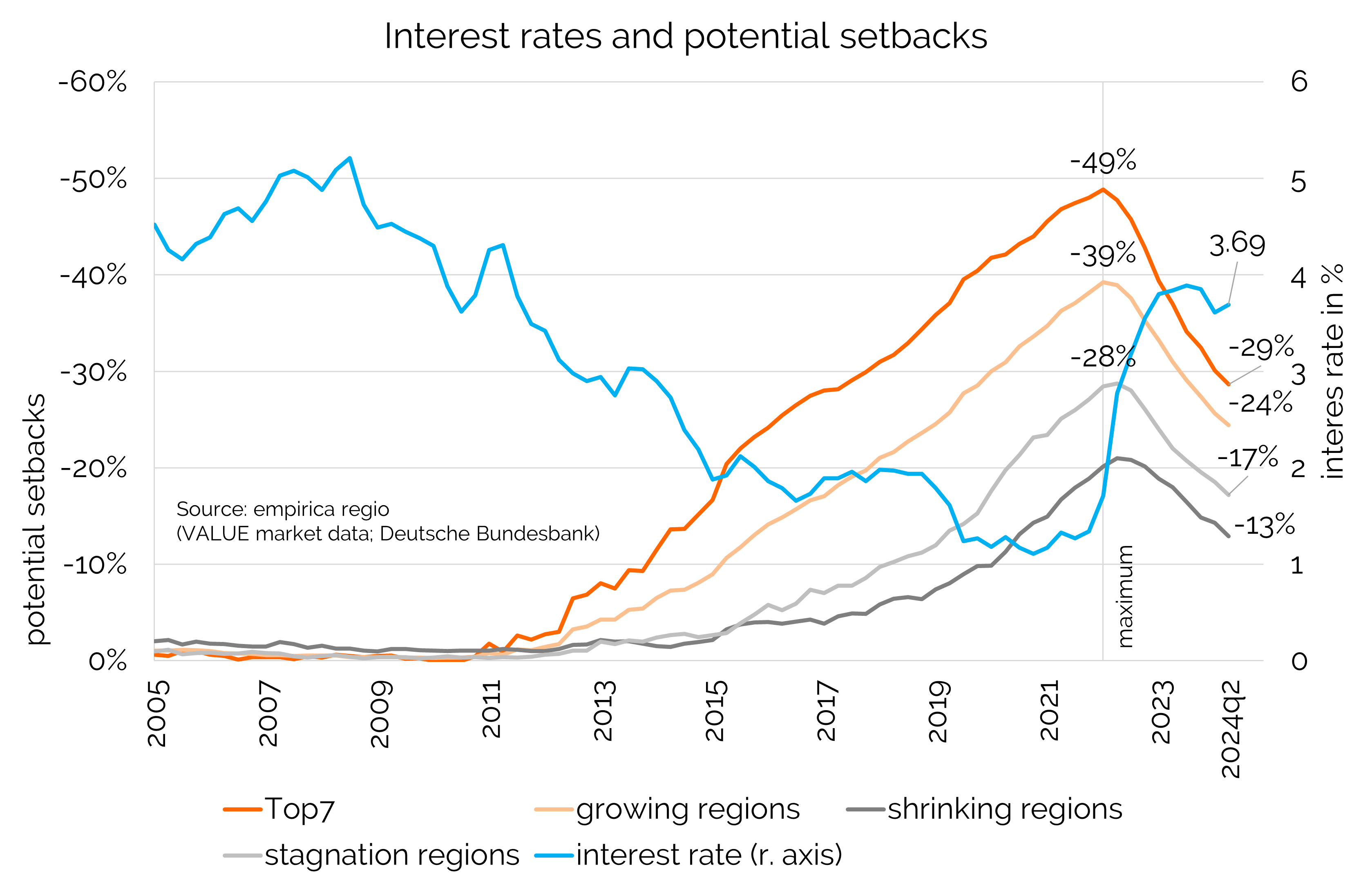

A new look at the rental segment

Analyses of rents usually refer to supply data. This data has been the subject of controversial debate for some time. The accusation is that publicly advertised rents represent a distorted picture of reality. Various analyses show that the overall market may be cheaper than the sub-market of publicly advertised flats online. New contract rents, which come about via personal networks or waiting lists of housing companies and estate agents, can only be observed to a limited extent. The 2022 census made it possible to look at the overall market once, but only on one reporting date and not again until the 2031 census. empirica regio’s new time series on contract rents, on the other hand, make it possible for the first time to look at the entire rental segment as a time series from 2010 and for all 400 districts and independent cities. This has now been made possible by means of estimation procedures based on the ‘Additional Housing Surveys’ of the microcensus. These were statistically adjusted, the region-specific surcharges for length of residence, year of construction and living space were calibrated and the values collected for very broadly defined regions (so-called adjustment layers, i.e. combined districts) were broken down to the smaller 400 districts and independent cities using estimation methods.

The analysis shows that contract rents have risen moderately across Germany, while new contract rents have increased more strongly. However, the trend is below the level of asking rents. ‘By publishing this data set, we are responding to the growing demand for reliable rental data that reflects the overall market,’ says Jan Grade, Managing Director at empirica regio. However, supply data continues to be an important source of data. Its advantages lie in the high degree of timeliness and high frequency of data availability. The new data from empirica regio can be used to better understand the differences between online listings and the overall market. ‘Overall, the rental market in Germany is diverse and characterised by regional factors. Our data makes it clear that a differentiated view is crucial in order to understand the housing market and develop solutions,’ summarises Grade.

More information

If you would like to order the data set directly, you are welcome to use our order form or take a look at the product page </a.

In empirica paper 273, the new contract rents from the new time series of empirica regio are compared with the 2022 census and the empirica property price index. You can download the analysis under the following link: