Making use of regional demographic trends - the example of Rostock

The example of Rostock shows how important regional population analyses are for investments in the housing market. Young adults are moving into the city, while rents are rising and vacancies are falling. Young workers and families, on the other hand, are moving to the surrounding areas or to other labor market regions. Therefore, the basic rule for investors is: They should base their strategies on solid demographic data in order to minimize risks and take advantage of opportunities.

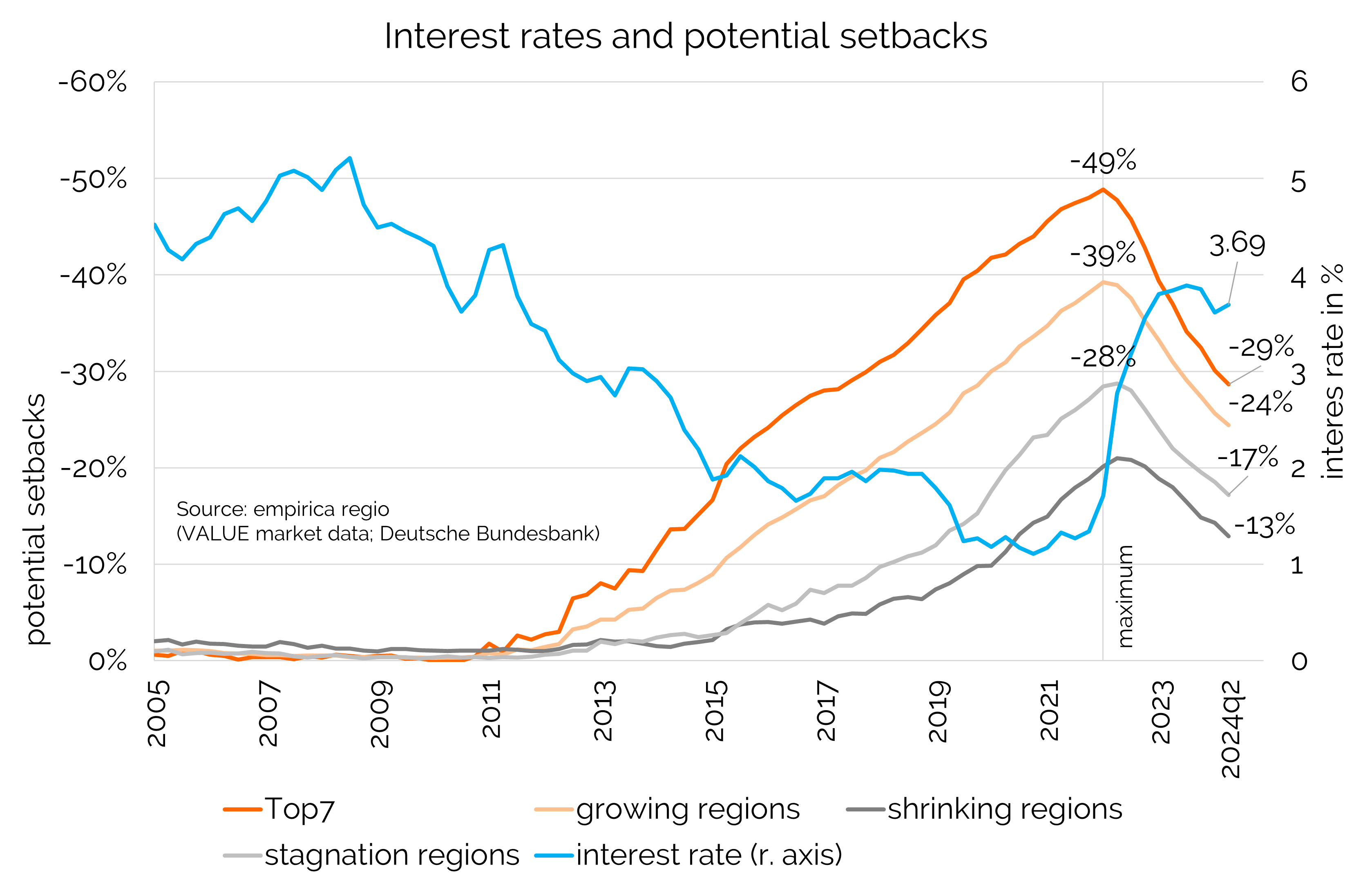

For long-term investment decisions, the future development of a region is of crucial importance. Various factors need to be taken into account, such as household development and the age structure in the respective region and the types of housing needed. All investors, whether they invest in the short or long term, should base their strategies on solid demographic analyses. The broad impact of developments can thus be incorporated into investment decisions and minimize risks.

Keeping the long-term perspective in mind

The demand for various types of real estate strongly depends on demographic development. For example, regions with an aging population offer great investment opportunities for nursing homes and assisted living, while younger, dynamic regions offer potential for rental housing construction and student housing. Demographic trends also affect the demand for consumer goods and services, which in turn influences the regional economy and other asset classes. This is not only interesting for institutional investors who use this demographic data to optimally align their real estate portfolios by also investing in infrastructure projects and corporate bonds. In general, the environment is also crucial for the value of a property.

Student apartment or assisted living?

The detailed analysis of age groups in certain regions, for example, allows precise predictions about the future demand for various housing concepts. A young, urban population increases the need for modern, compact apartments, while a high proportion of seniors increases the demand for barrier-free housing forms and supervised residential complexes. In addition, immigration from abroad influences the real estate markets, especially in urban agglomerations. Immigrants often move to cities where they find a corresponding job offer or already existing communities from their home countries. Students also look for housing in cities, which leads to an increased demand for student apartments. If young people stay in a region, e.g. after their studies, they will also need larger apartments in the medium term.

Necessary differentiation using the example of Rostock

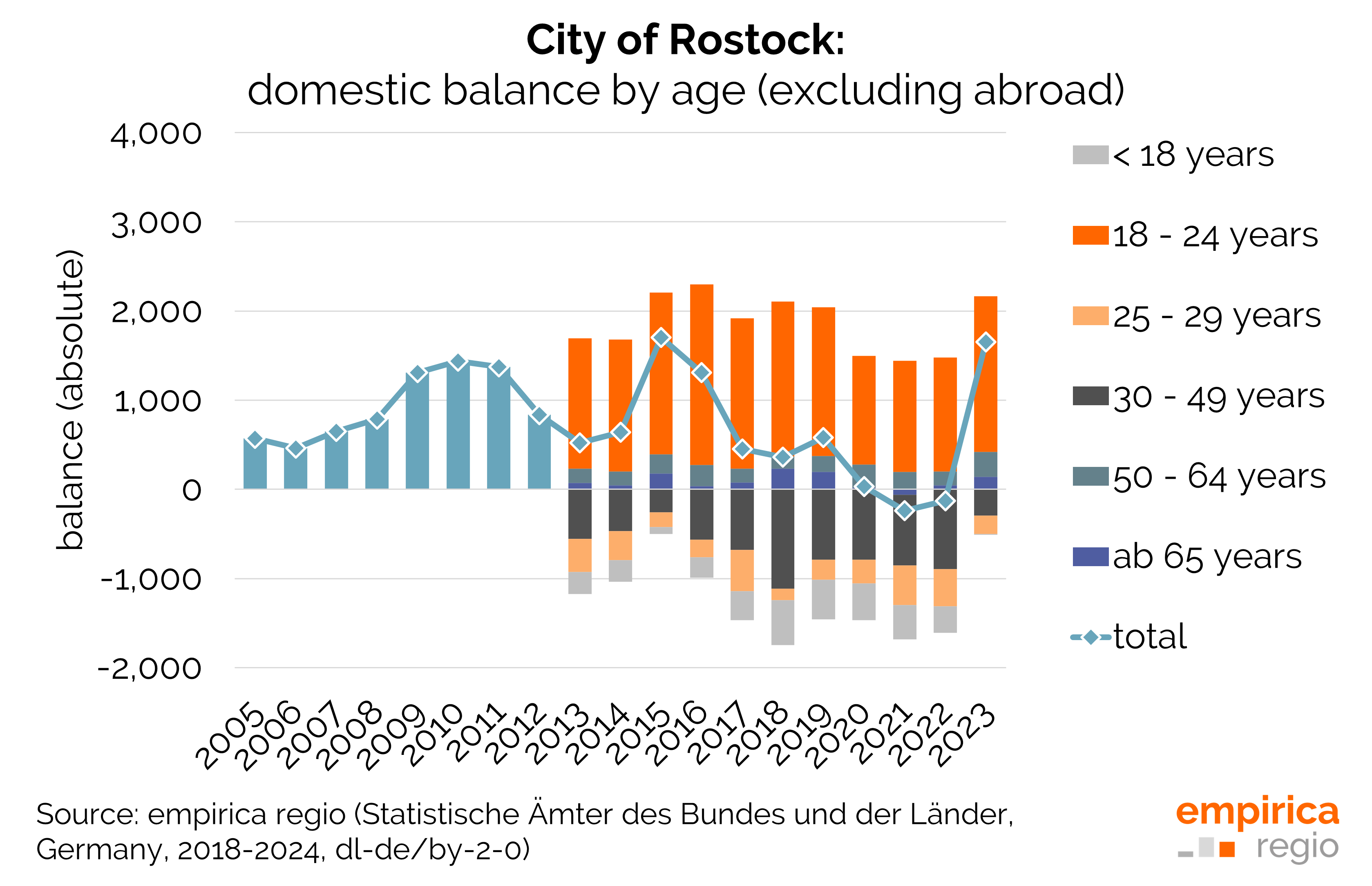

The example of the city of Rostock shows that a look at the regional conditions in connection with population forecasts is always necessary. For years, there has been a steady influx of young adults, which is mainly due to educational migration. At the same time, young workers and families are leaving the city for the surrounding areas but also for other regions in northern Germany. Possible reasons for this lie in the labor market, if the offer in other regions appears more attractive. Despite the immigration of adults, the population growth of the city cannot simply be extrapolated linearly. Because the crucial question is whether they stay in the city or in the region after their education.

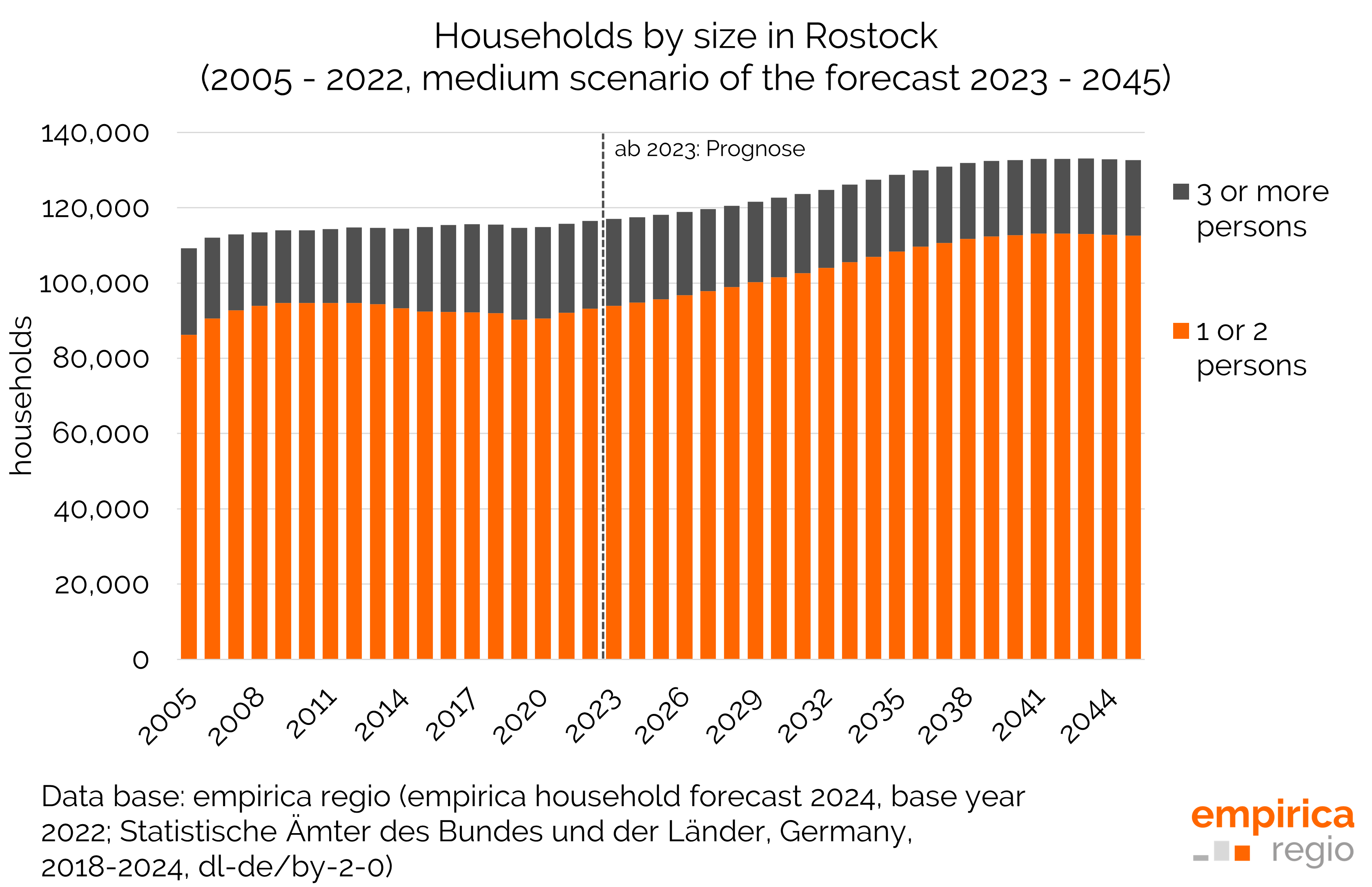

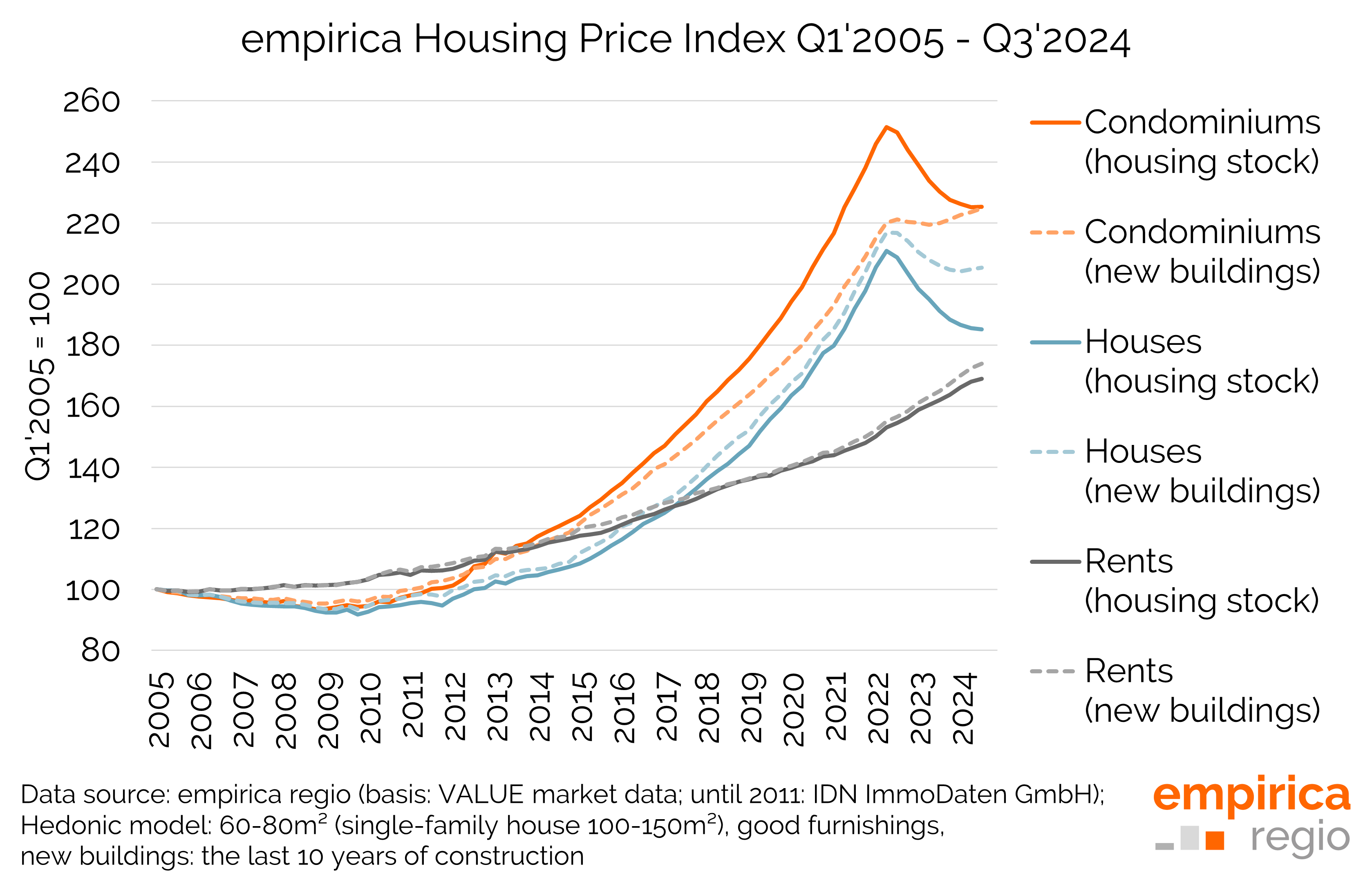

A delicate, but necessary question when it comes to future housing needs. The trend of rising rents and falling vacancies in the city, but also in the district of Rostock, shows that demand slightly exceeds supply. At the same time, the number of one- and two-person households has increased in recent years, while the number of multi-person households has stagnated. An investment in corresponding living space in Rostock could be worthwhile. The increase in small households will probably continue and is expected to last until the mid-2030s. Thus, vacancies in the city are likely to remain at a low level. The example of Rostock once again shows how important factors such as age cohorts, demand for certain types of housing or also regional interdependencies can be.

But beware: Regional housing shortages also change the future development and lead to an increased migration to the surrounding areas. This shifts the future demand within the region. It is also worth taking a close look here.

Demography checklist - what to look out for

To be successful in the real estate market, it is important to keep an eye on demographic trends and regional peculiarities. Our demography checklist shows you what to look out for:

Analyze trends:

- Observe population growth and aging.

- Track immigration and mobility of key groups.

- Track immigration and mobility of key groups.

- Regional peculiarities:

- Explore local demographic peculiarities.

- Adapt housing concepts to specific age groups.

- Use forecasts:

- Use reliable population forecasts for investment decisions.

- Regularly check the timeliness of your data.

- Economic conditions:

- Evaluate economic attractiveness and labor market conditions.

- Align your strategy with economic and demographic changes.

- Dynamically adapt:

- Keep your data up-to-date and adapt strategies flexibly.

- Keep your data up-to-date and adapt strategies flexibly.