Is the impact of energy efficiency on prices overestimated?

Various analyses have recently attempted to quantify the possible price discount on non-energy-efficient properties. Such a discount is undisputed, but the amount is probably overestimated. In a background analysis, empirica has examined more closely how this discount can be calculated on the basis of asking purchase prices.

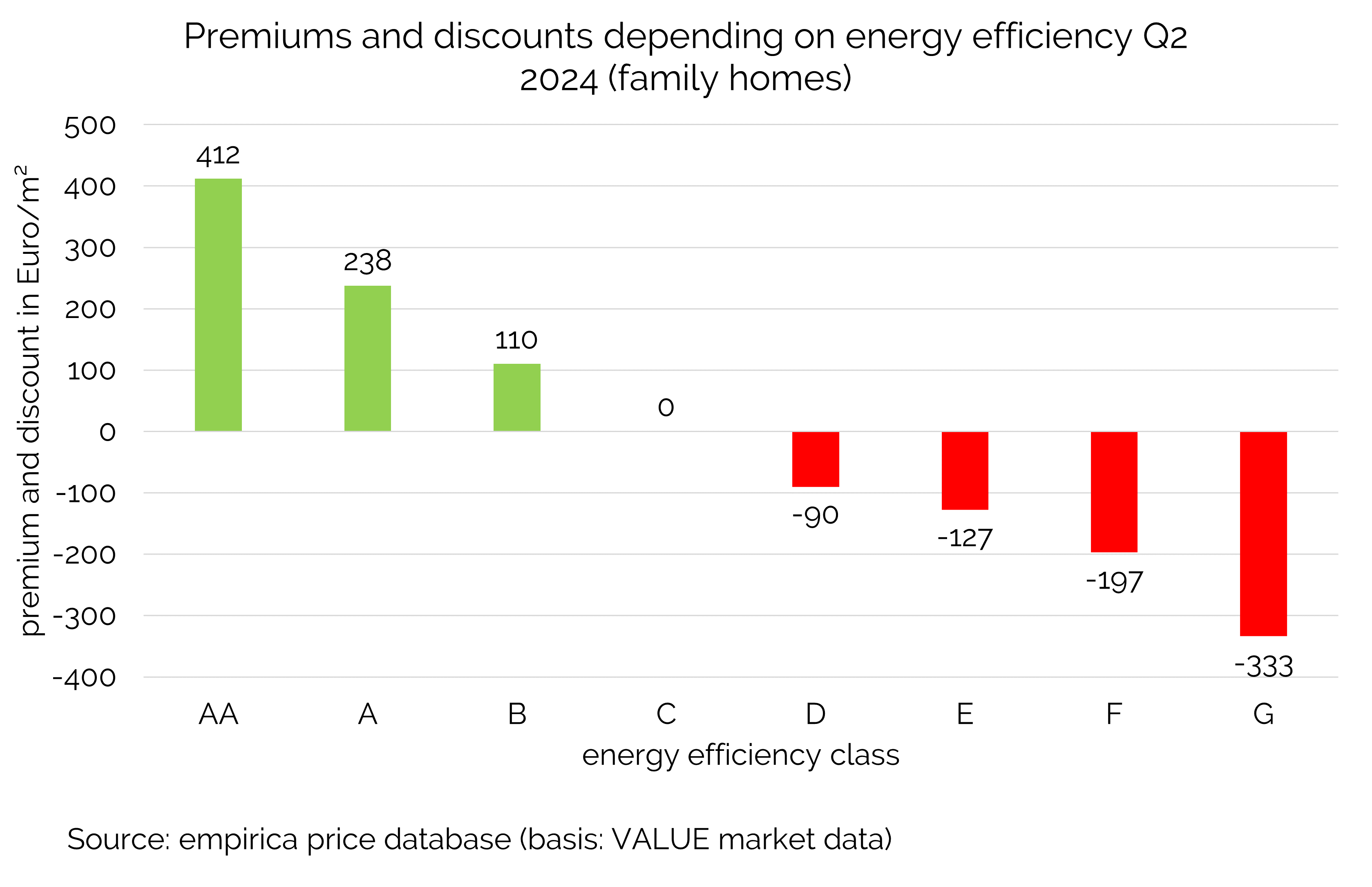

The energy efficiency class C was chosen as a reference. This results in premiums for classes B, A and AA, which are attributable to rising new construction costs. In contrast, there are discounts from class D onwards, which indicate poorer energy efficiency and impending refurbishment costs.

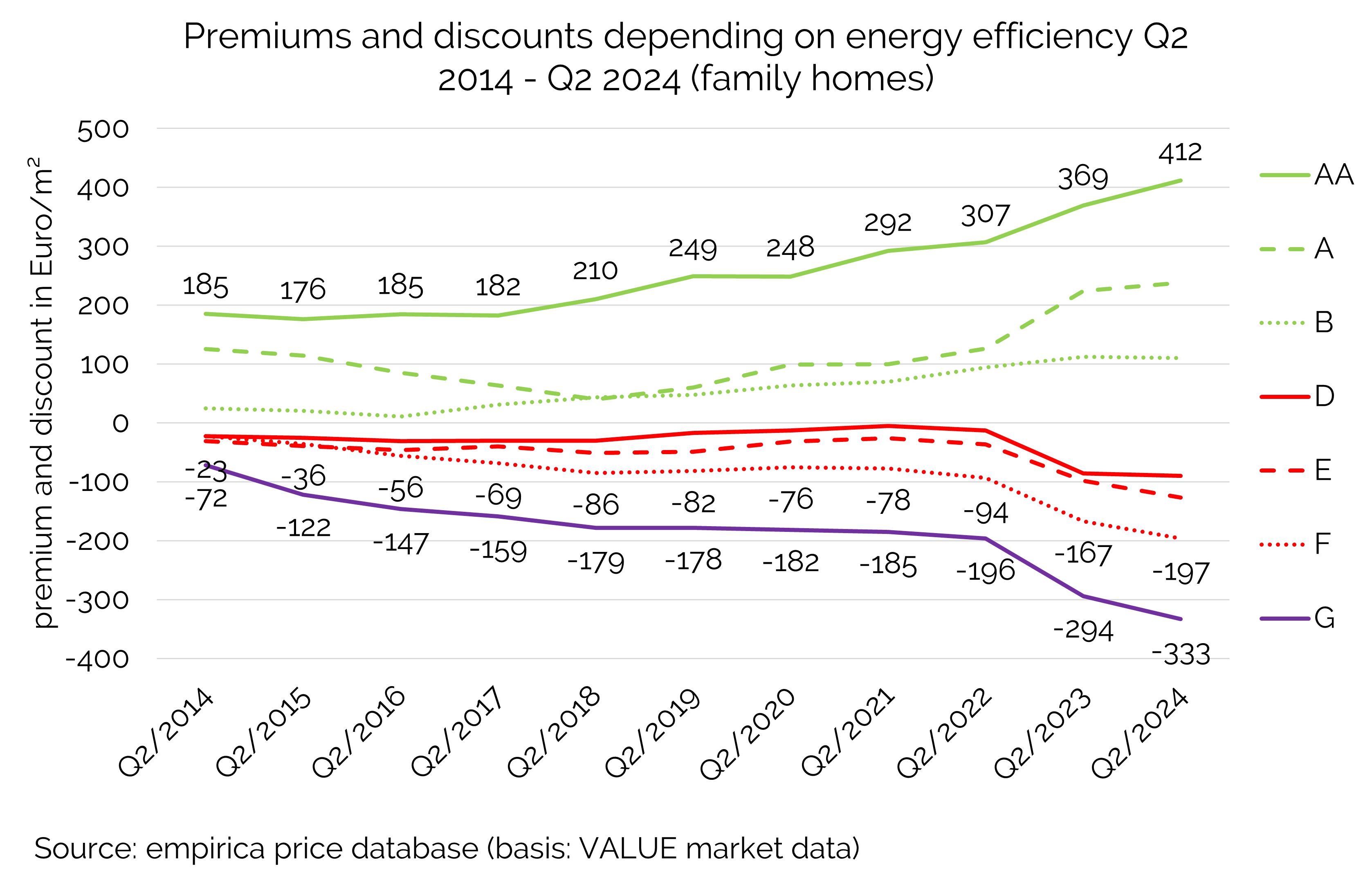

Reading aid: In Q2 2024, the hedonic model shows a discount of 333 euros/m² for energy efficiency class G and a premium of 412 euros/m² for class AA. The premiums and discounts for the other classes are in between. The reference is class C.The premiums and discounts continue to differentiate over time. For example, the premiums for class A have doubled over six years: from 210 euros/sqm in 2018 to 412 euros/sqm in 2024. In contrast, the discounts for class F stagnated for a long time at around 80 euros/sqm, only to double to 197 euros/sqm within two years after the start of the crisis in 2022. As the premiums for class B and higher have been rising since 2018, while the discounts for class D and worse only increased abruptly after the start of the energy crisis in 2022, we justify the choice of class C as a reference. It is therefore reasonable to interpret the discounts as a result of impending refurbishment costs and the surcharges as a result of rising new build costs.

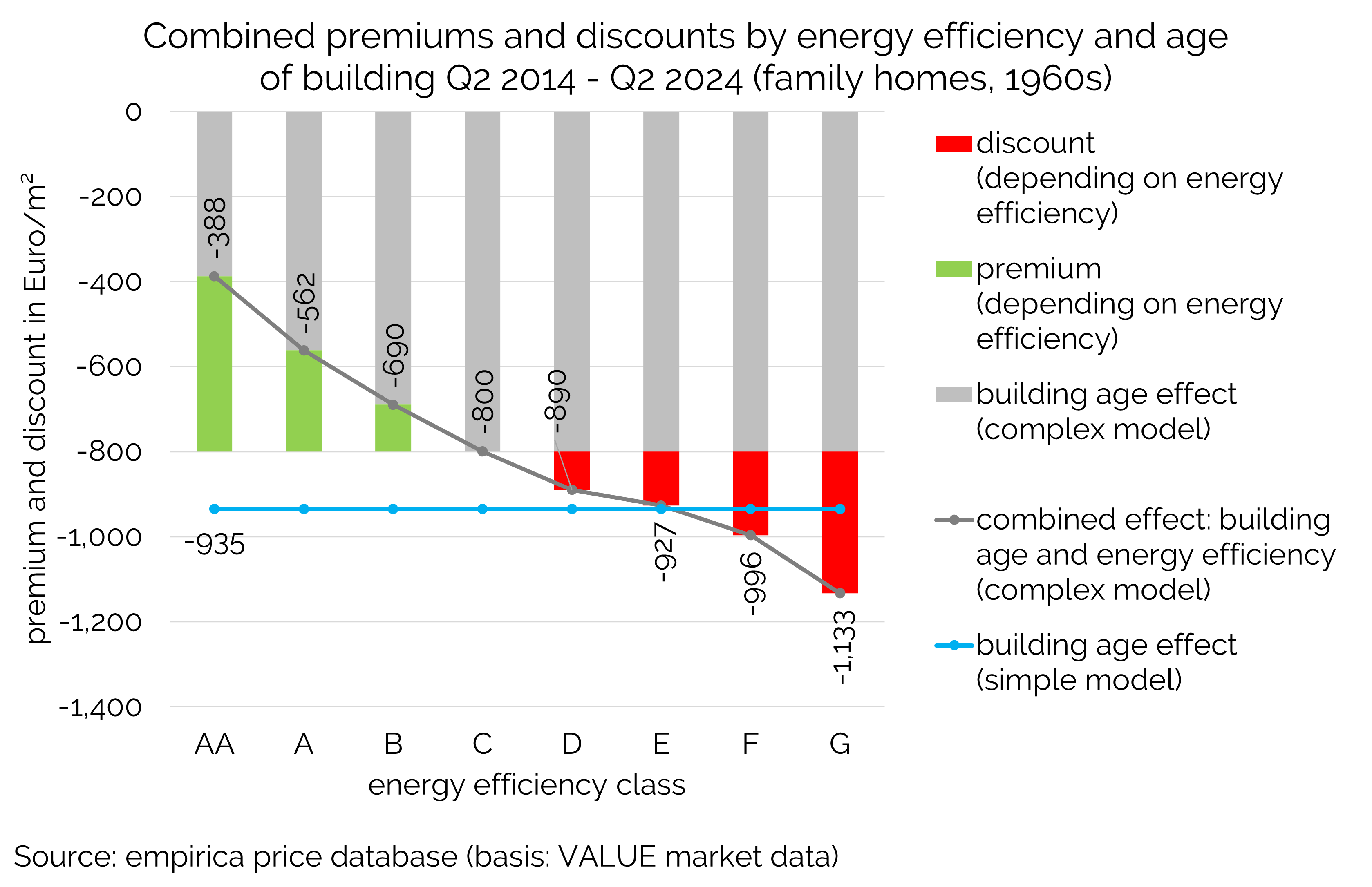

Reading aid: The hedonic model shows a differentiation of premiums and discounts for energy efficiency classes. The process will even accelerate from Q2/2022. The reference is class C.It is important to consider the calculation of premiums and discounts for energy efficiency in a more complex model in connection with the age of the property. Looking at energy efficiency alone is not enough. If building age and energy efficiency are considered in one model, then the discounts for building age are reduced. Nevertheless, the two variables cannot be clearly separated in the hedonic model. Hedonics can show the discount due to poor energy efficiency, but other variables such as building age should always be taken into account.

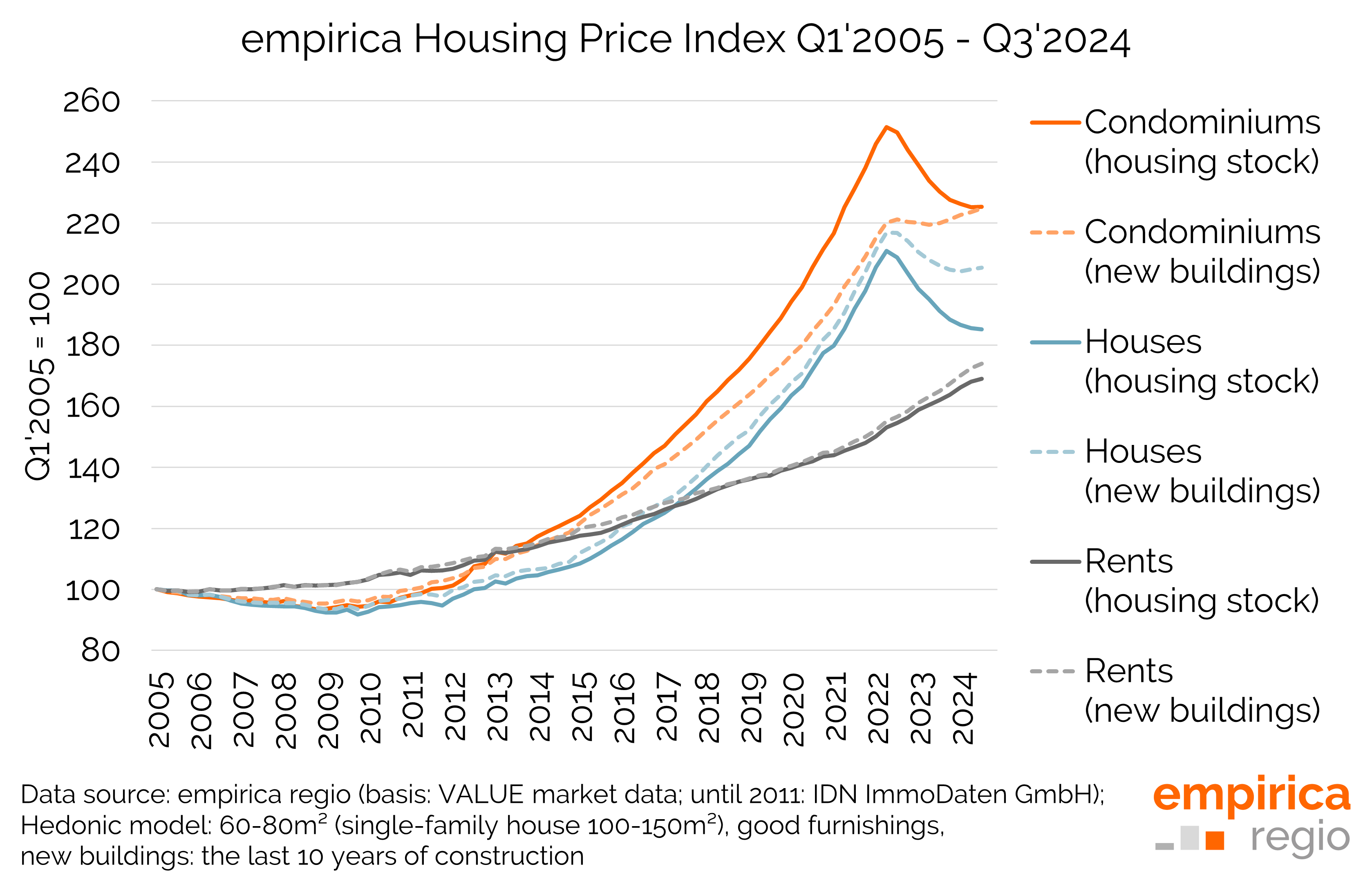

Reading aid: In the simple model without energy efficiency classes, the hedonic model shows a discount of 935 euros/m² (blue line) for 1960s buildings compared to new builds. In the more complex model, this discount is reduced to 800 euros/m² (light grey column for reference class C). If both effects (age of construction, energy efficiency) are added together, the result is the price discount for the respective class (dark grey line).Different premiums and discounts for asking rents and purchase prices can be analysed in the empirica regio market studio to examine the influence of different property characteristics in a region. Contact us for further information.

The entire analysis can be found in the analysis of the empirica property price index for Q2/2024 (in German only):