empirica housing market forecast - new construction demand of 243,000 residential units per year

The updated empirica housing market forecast on new construction demand is now available regionally differentiated for flats in single and two-family houses as well as flats in multi-family houses. Depending on the scenario, between 233,000 and 253,000 additional flats will be needed in the short term.

While this can satisfy the additional demand for housing, an expansion of the affordable segment in tight housing markets requires additional new construction. A more detailed discussion of the results can be found in the current empirica paper No. 263.1 The forecast data can be obtained by accessing the empirica regio Marktstudio.

Demand for new buildings until 2035

Three scenarios are considered for the forecast. Depending on the scenario, this results in an average annual demand for new housing of between 233,000 and 253,000 units for the years 2022 and 2023 for Germany as a whole. In the period 2023 to 2027, the annual demand for new housing decreases by 34,000 units in the upper scenario and by 47,000 units in the lower scenario. From 2032 onwards, the forecast shows a slight increase in demand. Here, a slight increase in demand in growth regions and increasing ageing have a positive effect on demand.

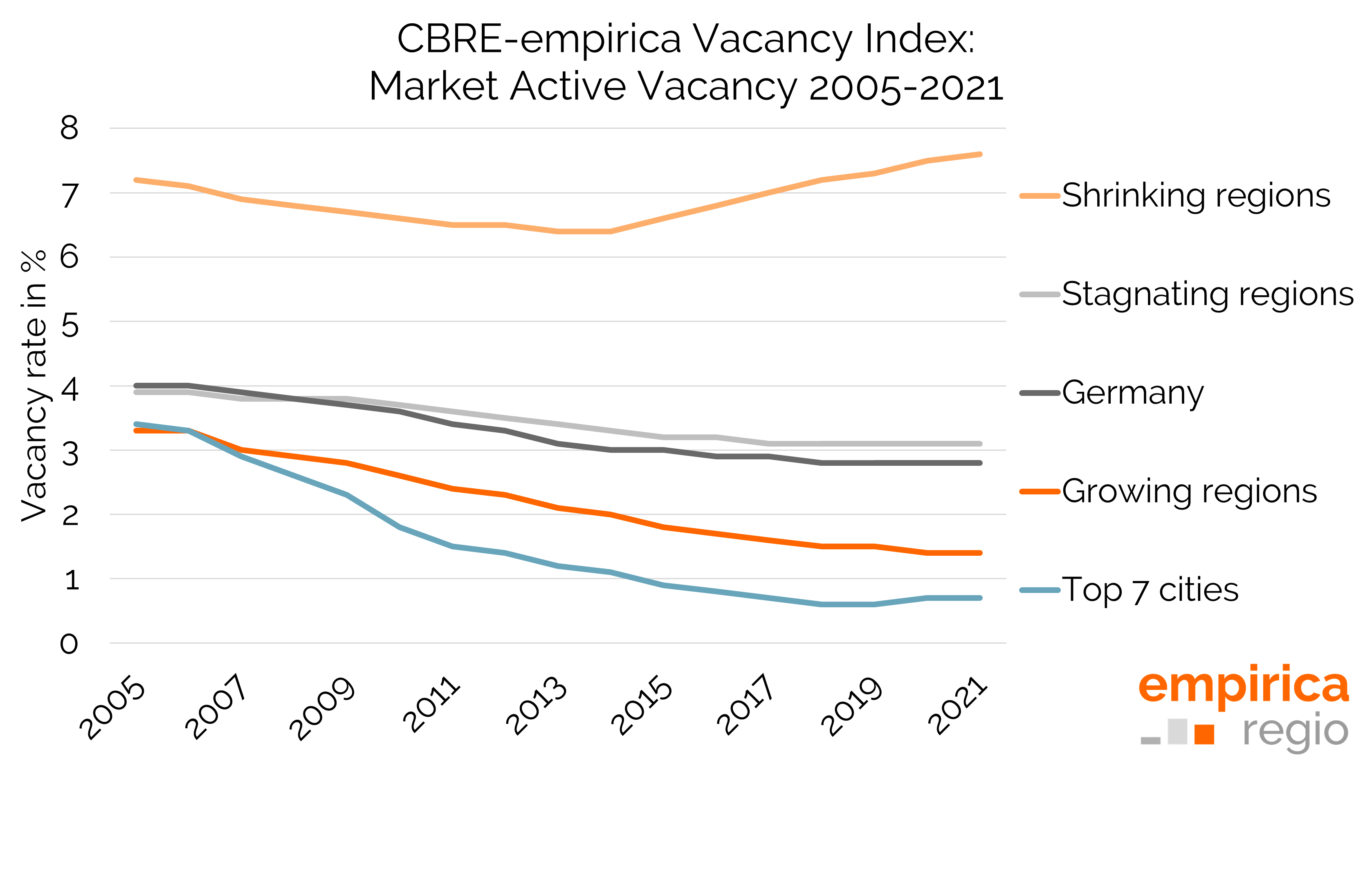

The forecast shows the estimated demand derived from the demographic development. But it does not represent a forecast of construction activity. The construction completions of around 306,000 dwellings available for 2020 are even higher than the demand estimate for 2022. However, model calculations by empirica show that this simplified, nationwide view does not take into account that some of the new construction is realised in the “wrong” regions. empirica estimates that around 80,000 of the dwellings completed in 2020 were realised in regions where there is no quantitative shortage. There are two reasons for this: Either not enough new housing can be built where there is a shortage and households move to other locations (keyword suburbanisation ) or new housing is built where the preferences of households cannot be realised in the existing stock, e.g. due to a lack of modernisation of older flats, and households then prefer new construction. The latter reason then leads to vacancies.

How is the demand for new buildings distributed regionally?

For detached and semi-detached houses, there is a higher demand for new properties in the area, especially in regions that are growing more strongly due to immigration and, in some cases, high birth rates. New construction demand for multi-storey flats, on the other hand, is concentrated mainly in the core cities and partly in the surrounding areas in regions with stronger growth.

Is there a need to catch up?

Earlier housing market forecasts by empirica repeatedly showed over the years that new construction demand was higher than actual construction activity. The question now is whether a backlog demand can be derived from this past demand. Here, the experts at empirica assume that this is only partly the case, because many households have already opted for a housing alternative due to a lack of supply, be it by moving out of the parental home later, as a shared apartment, or moving to a neighbouring region with a larger supply. “In purely quantitative terms (and at current prices!), there is no backlog demand; however, if the supply in the affordable segment is to increase, more housing would actually have to be built now for some time than the projected demand suggests,” the authors say (translation by empirica regio).

Methodology and data basis

-

Dr. Reiner Braun, Lukas Fuchs (2022), Wohnungsmarktprognose 2022/2023. Regionalisierte Prognose in drei Varianten mit Ausblick bis 2035 . empirica-Paper Nr. 263. ↩︎